Welcome to our first blog of 2024. While the festive season provided a much-needed break, it’s time to shift gears and focus on shaping your financial future this year.

Before we dive deep into exploring what to expect from the property market in 2024, let’s address the procrastination elephant in the room.

As life gets back into its usual rhythm with kids back in school and work routines resuming, it’s easy to push aside thoughts about your financial goals. However, I want to draw your attention to a previous blog where I emphasised the costly mistake of waiting.

In 2023 alone, those who hesitated missed out on substantial capital growth, exceeding $50,000.

Don’t let procrastination be the stumbling block in your journey to financial success, particularly with what’s in store for 2024.

Will the Momentum of 2023 Continue?

In 2023, property prices in Australia demonstrated remarkable resilience.

Despite a record increase in official interest rates, the country’s property market defied expectations, experiencing a consistent rise in values.

CoreLogic data reveals that Australian home values surged by 8.1% throughout the year, propelled by factors like undersupply, a resurgence in immigration, wages growth, low vacancy rates and higher rental yields.

The momentum of 2023 is expected to continue into 2024 with one big “game changer” to hit the market.

The “Game Changer” for the 2024 Property Market?

Undoubtedly, the surging Australian property market, combined with elevated interest rates, presents barriers to entry intentionally implemented to cool the growing economy and curb inflation.

However, consider this: what if the scenario changed? What if interest rates were to be reduced?

In the past year alone, pushing into an interest rate headwind, the Australian property price grew by a substantial 8.1% nationally, equivalent to over $60,000.

What would happen if rates were cut and is there any chance of that happening?

Major Bank Predicts Huge Fall in Interest Rates

The Commonwealth Bank anticipates a substantial reduction in interest rates in the coming year, forecasting a decrease of 0.75 per cent by the Reserve Bank of Australia (RBA) starting from September 2024.

This projection suggests a potential decline in interest rates from 4.35 per cent to 3.6 per cent by the close of 2024.

Moreover, CBA predicts an additional 0.75 per cent reduction in interest rates in 2025, aligning with the expected return of the inflation rate to the RBA’s target range of 2 to 3 per cent.

If these predictions materialise, interest rates could be at 2.85 per cent by the conclusion of 2025.

How Will This Translate into Property Growth?

The property market operates on a fundamental principle: the interplay between supply and demand. As interest rates decrease, a larger portion of Australians finds property acquisition more affordable due to reduced repayments. This, in turn, amplifies the overall demand in the market, exerting upward pressure on price growth.

The Demand Already Far Outweighs Supply

Last year, I published a blog dissecting a report that revealed expectations that property prices were set to soar by 25% and the fundamentals of this report remain relatively unchanged.

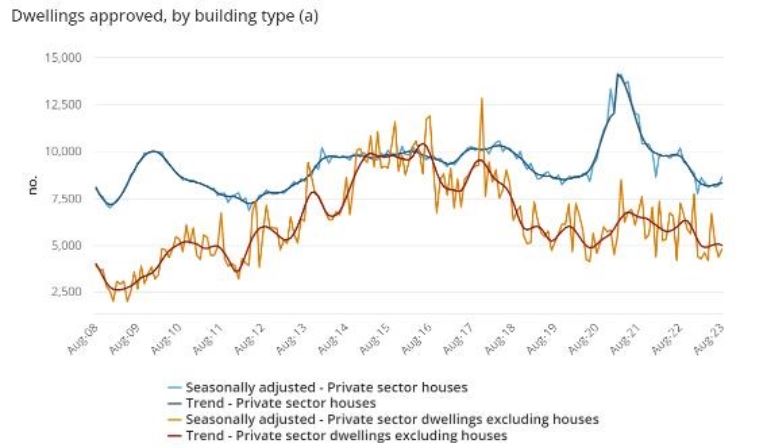

Limited housing supply is a key driver of property prices. This constraint in supply results from several factors, such as the scarcity of available land for new developments, falling approvals for new housing construction, and slower or more costly construction activity.

International Immigration of Skilled Workers Remains High

Data obtained by Wealthology indicates that over the next two-year period 600,000 new residents are set to call Australia home adding further demand to the housing market.

What the Major Banks are Predicting for 2024

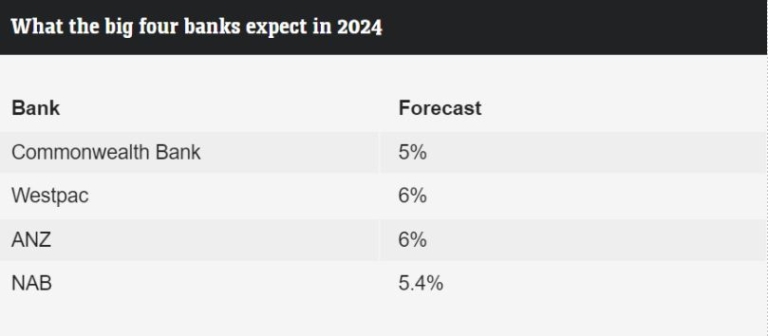

Economists from Australia’s prominent four banks share a common expectation for continued home price growth in the upcoming year, although the trajectory won’t be uniform.

The Commonwealth Bank anticipates a five percent national growth in home prices for 2024.

Westpac projects a six percent rise at the national level, with notable increases in Perth (10 percent), Brisbane (eight percent), Sydney (six percent), and Adelaide (six percent).

ANZ aligns with a six percent national increase, citing a housing shortage as a stabilising factor for prices. ANZ identifies Brisbane and Perth as the strongest markets due to anticipated population growth surpassing supply.

In NAB’s forecast, capital cities are expected to experience a 5.4 percent increase in home prices, led by Brisbane (6.5 percent), followed by Adelaide (6.2 percent), and Perth (6.2 percent).

The Problem with Bank Predictions

The forecasts primarily discuss overall market trends.

It’s crucial to recognise the diversity within the Australian property market, including submarkets within each city.

Wealthology’s clientele serves as a clear illustration of this complexity, as certain suburbs identified by our team have shown growth even when overall city prices remained stable.

Nevertheless, the predictions from major Australian banks, known for their conservative nature, should instil confidence in investors regarding the market’s future.

What is the Best Thing you Can Do in 2024?

It’s essential to clarify your long-term goals and envision your life in the next 5, 10, or 20 years.

As we enter 2024, a promising year for property investors, I believe it will serve as a launchpad for even more significant growth cycles in the coming years.

The key is not necessarily rushing to buy an investment property at this very moment but rather initiating the conversation.

Now is the time to begin planning and collaborating with professionals to develop your property strategy. This strategy will serve as a guiding light, keeping you on course to achieve your financial aspirations.

Don’t let 2024 pass by without taking steps that could potentially lead to substantial wealth. My inbox is open for those eager to explore these possibilities: leonie@wealthology.com.au.