The Australian property market is buzzing with energy, much like a light switch being flipped on.

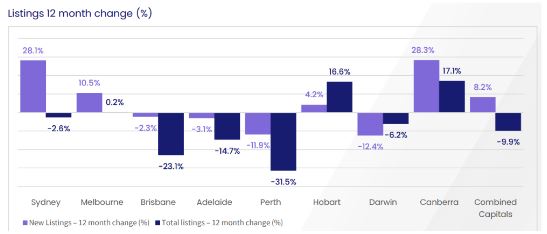

Everywhere you turn, conversations revolve around an impending property boom! With interest rates finding stability, listing numbers hitting record lows, property values steadily climbing, and rental yields on the rise, the market’s dynamics are shifting.

In today’s blog, I’ll delve into a recent report by KPMG, a globally recognized professional services organisation. This report unveils remarkable research and indicators that demand the attention of all property owners and investors.

25% Rise in Home Values

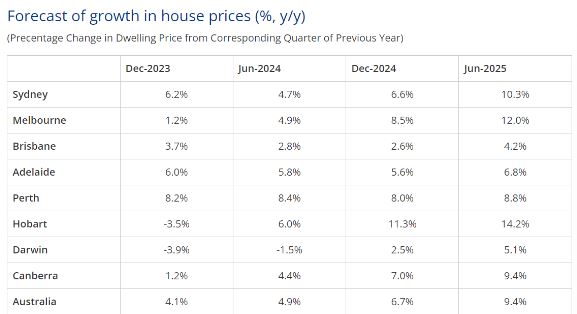

The report provides insight into the expected surge in house prices.

Let me simplify it for you. In the current quarter, we’re witnessing some remarkable forecasts:

- Sydney is set to grow by 6.2%

- Melbourne by 1.2%

- Brisbane by 3.7%

- Adelaide by 6.0%

- and Perth by a staggering 8.2%

Now, for our Brisbane clients with a median house price of $742,000, this translates to almost $30,000 in growth before the holiday season.

Sydney, on the other hand, is looking at approximately $80,000, and Adelaide is poised for around $44,000, all before the end of the year.

Exciting, isn’t it?

Longer Term Outlook

Peering into the horizon, these forecasts unveil an exceptionally promising landscape for property investors, one that beckons attention and action. Forecasts of this nature often serve as a catalyst, igniting a fervour within the market that can make securing properties increasingly competitive.

For those who recognise this window of opportunity and choose to act decisively, the rewards are boundless.

The report’s projections indicate an impressive 25.1% surge in home values on a national average scale by June 2025.

This isn’t just a market uptick; it’s a substantial leap in wealth potential for those poised to seize it.

The implications are far-reaching. Across the board, cities like Sydney, Melbourne, Brisbane, Adelaide, and Perth are set to embark on significant home value appreciation cycles.

Investing in a property valued at $650,000 today has the potential to transform into a remarkable asset worth $812,500 in just a matter of years.

This transition equates to an impressive equity boost of over $160,000, enhancing your financial portfolio significantly.

Does the Research Back Up These Claims?

It’s one thing to claim something, but it’s another to provide data to solidify these reports.

Dr Brendan Rynne, KPMG Chief Economist, said: “Despite high interest rates, constrained supply will likely dominate the factors influencing property prices in the short term and result in continued price gains in most markets during FY24. House and unit prices will then accelerate further in the next financial year as dwelling supply continues to be limited, due to scarcity of available land, falling levels of approvals and slower or more costly construction activity. The supply issue will combine with several other factors to push assets prices up – higher demand due to heavier migration; anticipated rate cuts moving into FY25, and potentially relaxed lending conditions; high rental costs pushing renters to look to buy instead; barriers to developers building new homes; foreign investor demand picking up again; along with the longer post-pandemic demand for more space as people continue to work from home.”

Let’s break down his statement:

Interest Rates:

Dr Rynne mentions that despite higher interest rates, these rates are not the primary factors driving property prices. This suggests that while interest rates are an essential consideration for property buyers and investors, they are not currently the dominant force impacting the property market. You can also read one of our recent blogs whereby the Big four banks predict rate cuts in the coming 12 months.

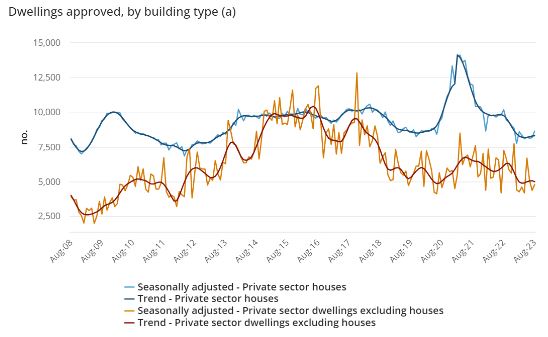

Constrained Supply:

Dr Rynne highlights that the limited housing supply is a key driver of property prices. This constraint in supply results from several factors, such as the scarcity of available land for new developments, falling approvals for new housing construction, and slower or more costly construction activity.

In essence, there aren’t enough properties to meet the demand.

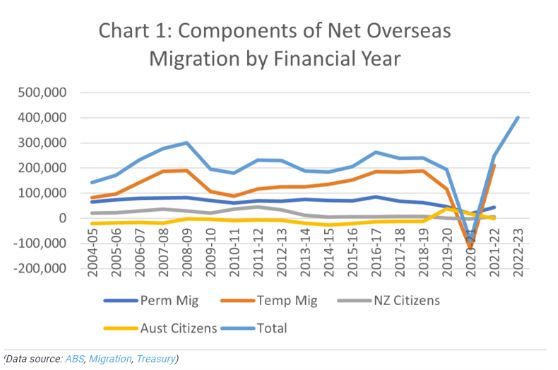

International Migration:

Increased migration into Australia is adding to the demand for housing. At the end of April 2023, the Government increased its net migration forecast for 2022-23 to 400,000 – up from its October Budget forecast of 235,000.

If realised, it will be the highest level of net migration in Australia’s history and certainly the biggest blowout from a treasury net migration forecast that I can find.

Potentially Relaxed Lending Conditions:

If lending conditions become more favourable, it could encourage more people to enter the property market.

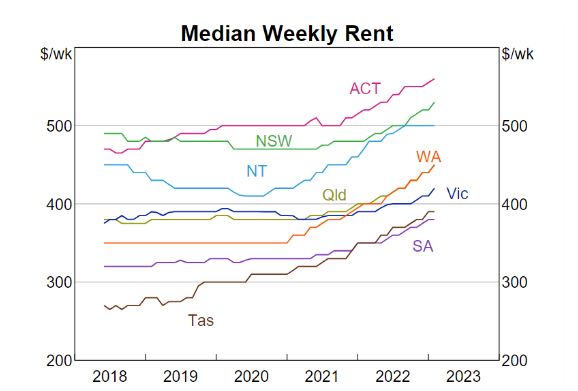

High Rental Costs:

Rising rental prices may motivate renters to consider homeownership as an alternative whilst making property investing more attractive to investors.

In this ever-evolving property market, opportunities are abundant, and the dynamics are changing rapidly. As you’ve seen from Dr Brendan Rynne’s insights and our discussion, now is a pivotal moment where the property market shows remarkable potential.

However, navigating this landscape can be complex, and that’s where guidance and mentorship play a crucial role.

As your advocates we are here to help you navigate this climate, offer insights, and provide you with the information and options you need to make informed decisions about your financial future.

If this blog has sparked even a glimmer of curiosity about your investment prospects, I encourage you to reach out. Consider it a no-obligation chat to explore how you can leverage the current market conditions to secure your financial future.

What do you have to lose? Your financial future could be just an email away. Connect with me at leonie@wealthology.com.au

You will find some additional info below:

A Beginner’s Guide to Investing in Property: The Basics You Need to Know