While Taylor Swift’s tour was the talk of the town, a significant development in the financial and property sector quietly unfolded which seems to have missed the mainstream news. Why am I not surprised J

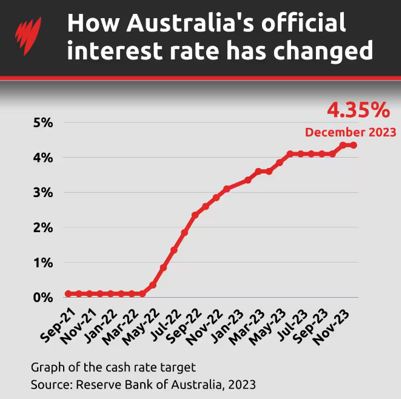

Australia’s leading bank made a pivotal announcement about interest rates, a subject at the forefront of discussions in recent years.

Given interest rates’ critical role in the housing market’s dynamics, this update cannot be overlooked. For those who read my blog, “The Game Changer Set to Hit the Australian Property Market in 2024!” you’ll understand why this announcement is such big news.

Commonwealth Bank Forecasts Six Rate Reductions by Mid-Next Year

The Commonwealth Bank of Australia, the nation’s leading lender, is projecting six interest rate cuts in 2024 and 2025, starting as early as September this year.

These adjustments are expected to lower the RBA cash rate to 3.6% in the latter half of 2024, a significant decrease from the 12-year peak of 4.35%.

Rates could further drop to 2.85% by mid-2025. For our clients with variable-rate loans, this forecast suggests a potential reduction in monthly mortgage payments. This would offer a welcome reprieve and enhance financial flexibility.

Increased Borrowing Capacities On The Horizon

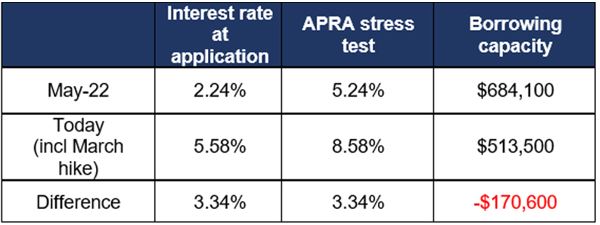

When interest rates decrease, individuals have enhanced borrowing capabilities, enabling more potential buyers to purchase properties or allocate greater funds towards property investments.

This table illustrates a notable decline in the average borrowing capacity by $170,000 from May 2022 to March 2024. The ripple effects of increased borrowing capacities on the market are significant and easy to foresee.

What does this mean for you as a property investor?

As we enter 2024, the property market presents a contrast that demands a keen eye and a strategic approach from investors.

This year is anticipated to unfold in two distinct phases, offering a unique window of opportunity for those with a long-term investment horizon.

Understanding the dynamics at play can unlock significant value for property investors ready to act with insight and precision.

The Dawn of a New Property Cycle

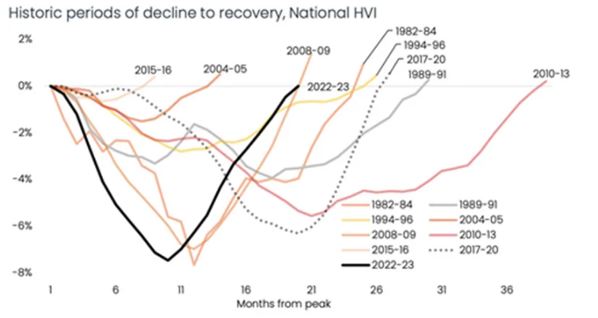

The early stages of a new property cycle are at the heart of the current market landscape, a rare and pivotal moment that can shape investment outcomes for years to come.

While timing the market to perfection is a challenge, the signs are clear: we are past the trough of the cycle, with the bottom having occurred in early 2023.

The question is not about capturing the lowest point but recognising and leveraging the opportunities that this phase of the cycle presents.

The Window of Opportunity

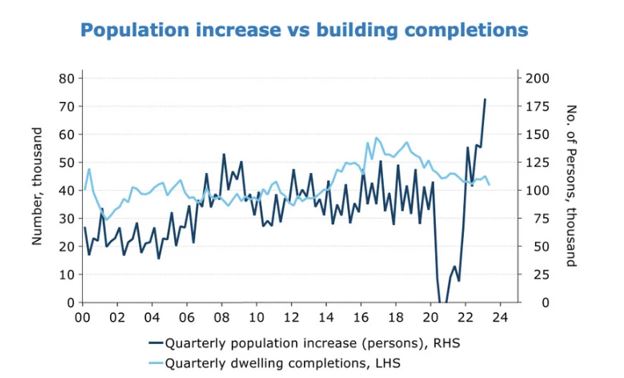

The confluence of demand and supply dynamics sets the stage for a promising period for astute investors.

With immigration levels reaching record highs and a shortfall in property construction, the imbalance between demand and supply is poised to intensify.

This scenario is further compounded by escalating construction costs, which are driven by supply chain disruptions, labour shortages, and financial viability concerns among builders and developers.

These factors collectively signal a period of appreciating property values, particularly for new developments and estates.

Consumer Sentiment and Market Dynamics

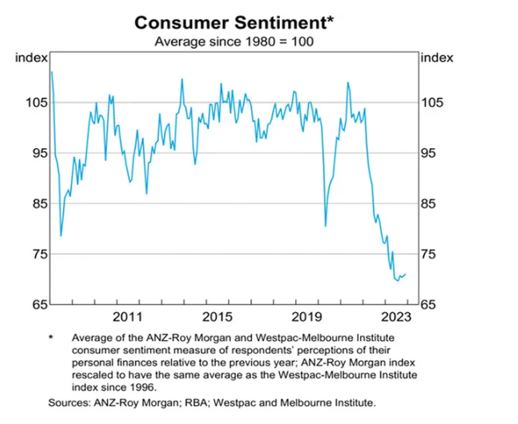

A pivotal turn in the market is on the horizon as consumer sentiment is expected to shift with the stabilisation and subsequent decline of interest rates.

This transition will unleash pent-up demand, driven by the fear of missing out (FOMO), replacing the current caution characterised by the fear of buying early (FOBE).

Prices across Australia rose almost 10% in 2023, and that was despite consumer sentiment being at almost record lows.

Such psychological shifts in consumer behaviour are typical of progressing property cycles and can create fertile conditions for investment growth.

The Rental Market: A Crisis and an Opportunity

The rental segment of the market is set to experience unprecedented pressure, exacerbating the ongoing rental crisis.

This situation presents a dual-faceted opportunity for investors: not only can they contribute to alleviating the shortage of rental properties, but they can also position themselves to benefit from the anticipated surge in rental yields.

The key is approaching this with a mindset focused on providing solutions rather than exploiting challenges.

Strategic Investment Approaches

The conventional wisdom of hunting for bargains may not be the most prudent strategy.

Instead, investors should concentrate on acquiring investment-grade properties in prime locations.

Such assets, characterised by their scarcity and intrinsic value, offer not only immediate price advantages but also superior long-term stability and growth potential.

This approach mitigates risks associated with market volatility and oversupply, ensuring a robust investment portfolio capable of weathering market cycles‘ ebbs and flows.

The property market is at the start of a new cycle. With three decades of experience, I know that now is the time for property investors to make life-changing profits on their portfolios.

If you are looking to get yourself in a position to take advantage of this new cycle, then reach out to me directly at – leonie@wealthology.com.au