Ah, the memory of the mortgage cliff, etched in newspaper headlines and vividly broadcasted on our screens. Who could forget?

It was that moment when the media painted a picture of impending doom – when mortgage holders transitioning from fixed rates in the 2’s% to variable rates in the 5’s% were said to hit the breaking point.

Streets were meant to be lined with “For Sale” signs, bargain properties aplenty, and property prices plummeting off the precipice. Ring a bell?

Reality has shown a different tale. Yes, there’s a cliff, but guess what? Property prices are set to ascend it, reaching even greater heights.

What is a Mortgage Cliff?

To be honest, even after three decades as a property investor, I hadn’t come across this term. It’s a fresh addition to the vocabulary, striking fear into borrowers nationwide.

The term “mortgage cliff” emerged due to the Reserve Bank of Australia’s decision to raise the official cash rate by a significant 400 basis points within just 14 months.

This term suggests a scenario where those who moved from super-low fixed-term loans, secured between mid-2020 to mid-2022, to loans with interest rates possibly three times higher.

The figure for home loans moving from a fixed rate to a more expansive variable rate is approximately $350 billion.

Are We Prepared for Impending Doom?

We’re all familiar with the potential issues, but truth be told, Australians are standing on solid financial ground. While it’s important to acknowledge the challenges that transitioning from ultra-low interest rates to higher ones might bring, it’s equally crucial to grasp the broader dynamics at play.

Remember my recent blog on historic interest rate levels? Even after a dozen interest rate hikes, our current rates are relatively “normal.”

Furthermore, insights from the RBA’s six-month Financial Stability Review, released in April 2023, point to a robust household sector balance sheet in Australia as of December 2022.

Although household asset values slipped by 2% in 2022, they remained a whopping 25% higher than those at the end of 2019. Additionally, households boasted substantial liquid assets, aligning with their liabilities.

The report also highlighted how a “strong labour market” bolsters household finances. Most borrowers had wisely built up savings buffers to brace themselves against rising interest rates.

The RBA’s report even goes beyond, revealing that broader measures of liquid savings – extending beyond funds held in redraw and offset accounts – underscore even greater resilience against increasing rates and living costs.

Even the recently appointed RBA governor, Michele Bullock, shared this sentiment in July, affirming that households were indeed in a “fairly good position.”

Mortgages Arrears Below Long-Term Averages

You might be wondering, “How’s Australia holding up against these challenges?”

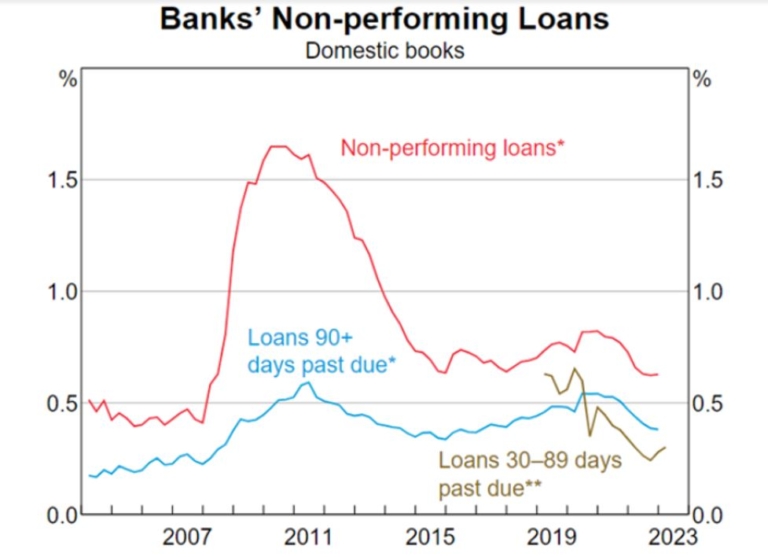

The graph below, crafted by APRA and the RBA, paints a reassuring picture. It illustrates that major banks in Australia are reporting arrears levels below long-run averages, spanning both 30- and 90-day windows.

Even foreclosure data is tracking beneath the long-run averages. This powerful data indicates that the anticipated surge in arrears due to the expiration of fixed rates hasn’t materialised.

Data sourced from the Australian Prudential Regulation Authority echoes the sentiment, emphasising that the count of defaults and arrears remains “extremely low” despite the cash rate surging to 4.1%.

In essence, only a small fraction of borrowers are either making late mortgage payments or facing challenges in making payments altogether.

The official data paints a picture that contradicts the notion of an arrears crisis stemming from the conclusion of low fixed-term loans.

Furthermore, the ascending trajectory of home values also significantly reduces the risk of defaults.

As you might have gleaned from our social media updates, property prices continue to ascend across the nation.

How Are Australians Absorbing the Increase in Mortgage Repayments?

There’s no denying the impact of the recent surge in interest rates on those holding mortgages.

However, Australians have once again demonstrated what we’ve long known – our resilience shines through. Our reputation as adept borrowers remains steadfast, with global data reflecting our enviable track record of low default rates and minimal arrears.

Moreover, Australian consumers have responded to the interest rate hikes and the strains of living costs by scaling back their spending.

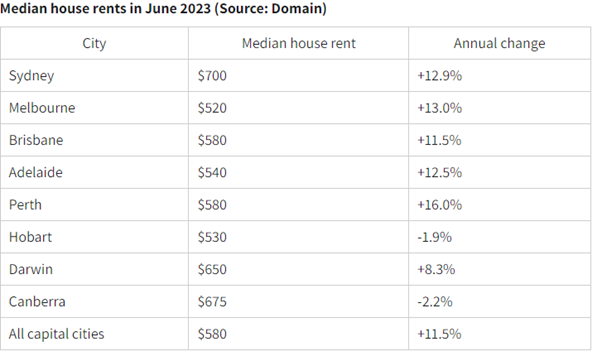

For property investors, the added burden of increased repayments has been alleviated by the surge in rental income witnessed across rental properties over the last couple of years.

Recent data from the property analytics firm PropTrack reinforces this trend.

Rents in the combined capital cities have continued to climb, experiencing a remarkable 5.8% rise in the June quarter alone, settling at an average of $550 per week.

Over the span of a year, this increase totals an impressive 17%.

What Happens Once We Pass This “Cliff”?

A few months back, I penned a blog discussing a crucial element for the impending property boom: confidence.

As Australia’s property market persistently displays its strength, confidence becomes an integral component, akin to fuel igniting a fire that triggers a fervent surge in demand.

The trajectory of property prices, steadily ascending in recent months, serves as a potent reflection of the market’s robust demand.

Despite the backdrop of heightened borrowing costs and the infamous “mortgage cliff,” property prices have continued to edge upwards, showcasing the market’s resilience.

Astute property investors recognise the unique window of opportunity that is open before us.

It’s a moment to seize exceptional assets that will navigate the waves of this impending growth cycle.

With interest rates potentially at their peak (you can delve into the major bank predictions – here), their eventual decline in the upcoming year seems inevitable.

Coupled with the perpetual shortage of rental properties, which shows no signs of abating, rental yields are poised for continual growth.

In parallel, Australia’s surging population adds a layer of stability to the broader market.

Whether you’re seeking to capitalise on the imminent growth cycle or simply wish to exchange ideas, feel free to connect with me directly at leonie@wealthology.com.au.

The journey to investment success begins with a conversation.