I’ll get straight to the point and maybe ruffle some feathers here, but seriously, “WHAT ARE YOU WAITING FOR?”

Just the other day, a client called me out of the blue and declared, “Leonie, we’re ready to move forward and are on the hunt for a property similar to the one we nearly purchased nine months ago in Brisbane.” My response was straightforward, “That property is no longer available.”

You see, over that period, property prices have continued to surge, and the same property now commands a higher price than when they initially considered it.

If your goal is to build wealth and secure your financial future, one of the worst things you can do is do nothing (or wait).

I’ve witnessed it repeatedly: individuals with the right intentions but lacking the courage to take action.

We’ve laid out the investment strategy, pinpointed promising locations through in-depth analysis, and even identified the ideal property to serve as a vehicle toward their financial aspirations.

However, all of that becomes meaningless if you don’t execute. Ho hum…

My concern is that others may continue to wait, losing touch with the market and the opportunity to secure a comfortable retirement.

That’s why I want to shed light on the cold, hard facts regarding the cost of waiting and what procrastination could ultimately cost YOU. Yes, you!

Don’t Wait to Buy Real Estate, Buy Real Estate and Wait!

A quote that has stuck with me since my early days as an enthusiastic investor, some three decades ago, rings truer than ever today. The property market’s ebbs and flows follow what we call “property cycles.”

However, one invaluable lesson I’ve gleaned is that attempting to time the market’s absolute bottom is a near-impossible feat.

More often than not, waiting for the perfect bottom turns out to be a costly mistake.

Now, let me clarify that I’m not singling out this particular client; their situation merely serves as a valuable illustration of the potential costs associated with waiting.

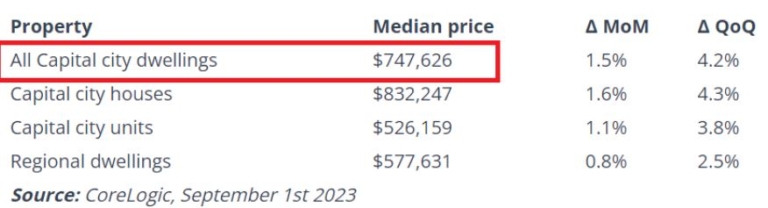

Consider this: nine months ago, in January, when these clients were ready to make a purchase but chose not to proceed, the median price in Brisbane stood at $698,204.

Fast forward to September 2023, and that median price has climbed to $747,626. What has it cost them?

A significant $50,000 in missed capital growth.

They Didn’t Just Miss Out On Capital Growth

The impact of forgone capital growth is disheartening; indeed, $50,000 can represent a full year’s wage for some. However, waiting may have exacted an even more profound cost – the chance to secure an A-Grade property.

Nine months ago, amidst widespread apprehension about rising interest rates and media-fuelled predictions of catastrophic property crashes (which, incidentally, never materialized), the market boasted more of what I term A-grade properties.

Now, here’s the crucial point: an A-grade property tends to outshine average properties and surpass the performance of most others in different locations. So, if the decision to wait led to missing out on an A-grade property purchase nine months ago, you might have potentially missed out on a lot more than $50,000 in capital growth. Ouch!

What Is the Cost Long Term?

In a stable market, one that’s neither booming nor busting, the average property tends to appreciate at approximately 5% per annum, while an A-grade property can outperform significantly at around 8%.

Consider this scenario: Back in January 2023, that A-grade property in Brisbane, valued at $698,000, has now surged in value to $879,278 by September 2027, growing consistently at an impressive 8% per annum.

Meanwhile, the average property you might have opted for today, valued at $747,626, has appreciated but to a lesser extent, is now worth $823,567.

Here’s the stark contrast: Had you not waited, you would have realised a remarkable $181,278 in capital growth in just three years.

However, by choosing to wait, you’ve still enjoyed capital growth, but it’s substantially less, amounting to $75,941.

This is primarily because you spent nine months less in the market and invested in a lower-performing property.

So You Still Think You Might “Wait” for the Market to Drop…

It’s an undeniable reality that the current state of the housing market is in the midst of a robust recovery phase.

Brisbane (in particular) stands out as an area of immense opportunity for your clients, thanks to several compelling factors:

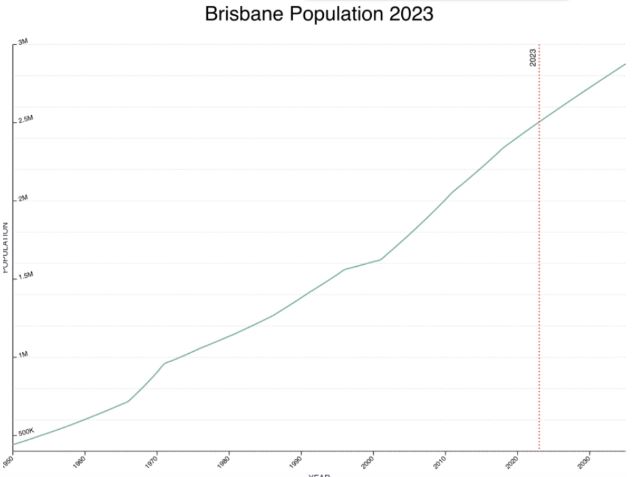

Record Migration: Australia’s population is on track to nearly double by 2055, with Queensland expected to house over seven million people in the next four decades. Unprecedented levels of international and interstate migration are fueling this growth.

Infrastructure Investment: The power of infrastructure spending in the realm of residential real estate cannot be overstated. It possesses the ability to transform local economies and trigger real estate booms.

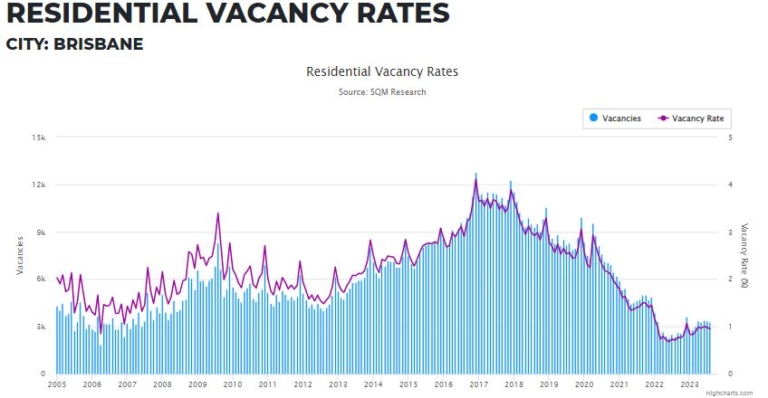

Strong Rental Market: Brisbane’s rental market remains highly favourable for landlords in 2023, with asking rents reaching historic highs.

Low Vacancy Rates: Traditionally, Brisbane has maintained tight vacancy rates, consistently staying well below the 2.5% threshold, which typically characterizes a balanced rental market.

Recovery Phase: Brisbane’s property market has unmistakably transitioned into the recovery phase of the property cycle, demonstrating seven consecutive months of rising median property prices.

Promising Future: Numerous indicators suggest that Brisbane is poised to become one of the most robust housing markets in 2024.

2032 Olympics: Hosting the 2032 Olympics will place Brisbane on the global stage, offering unique lifestyle and economic advantages that will attract overseas migrants, as well as create ample job opportunities for highly skilled knowledge workers.

Population Growth: Federal government forecasts anticipate Queensland’s population will expand by over 16% by the time Brisbane hosts the Olympic Games in 2032.

These factors collectively underscore Brisbane’s status as a prime area for investors and a market with substantial growth potential for our clients.

Source: SQM Research

There Are Still A-grade Properties Available

The encouraging aspect of this situation is that these clients are not facing a dire predicament.

Drawing upon my three decades of wealth guidance for Australians and continuous monitoring of real estate markets, I’ve honed the skill of pinpointing opportunities, and they still exist but they are becoming rarer to find.

Right here, right now, I’m presenting these opportunities to you if you’re ready to forego waiting and take proactive steps toward securing your future.

Those who decide to invest in an A-grade property in Brisbane at this point will undoubtedly look back in a few years and acknowledge that they made a shrewd move.

Brisbane’s market has successfully navigated the bottom of the cycle and entered the upturn stage, marking a pivotal moment in the property cycle.

A confluence of positive growth drivers is propelling Brisbane’s house prices forward.

The recent confirmation of Brisbane winning the 2032 Olympic Games serves as a catalyst, ensuring robust infrastructure growth, economic expansion, and a surge in population over the next decade.

If you’re eager to explore how you can secure your A-grade property, feel free to connect with me directly at leonie@wealthology.com.au