The end of the year is near. Time has a way of eluding us, and it’s a common theme in many conversations I have.

People often express their intention to address their financial future in the coming year, only to find themselves at the year’s end without having taken any action.

It’s not due to a lack of desire or financial capability; rather, it’s a matter of prioritising today without considering the future age when taking action may become too late.

A heartfelt congratulations to my clients who seized the opportunity to act this year.

Your commitment to enhancing your financial security deserves acknowledgment. Be proud of the steps you’ve taken; this marks just the beginning of your journey.

In today’s blog, I wanted to reflect on the year that was 2023 in the property world.

“The Market Is Going to Crash”

The media’s sensationalism in the early part of 2023 bordered on the comical, with headlines predicting significant drops in values across Australian residential real estate, as seen below.

The truth is, bad news sells, and unfortunately, these headlines likely instilled fear in those in a position to invest.

For those who might have been influenced by this fearmongering and delayed their decisions, it serves as a crucial reminder to seek appropriate advice and guidance from professionals rather than relying solely on sensationalised journalism.

Let’s now dive into what really happened in the market.

Australian Median Property Values Reach Record High.

Australia’s median property value is now at a record high of $753,654. Since bottoming out in early January, the national home value index has risen by 8.1%, taking the market to a new record high on Wednesday, 22 November 2023.

Sydney is still the most expensive place to buy a property, with a median house value of almost $1.4 million.

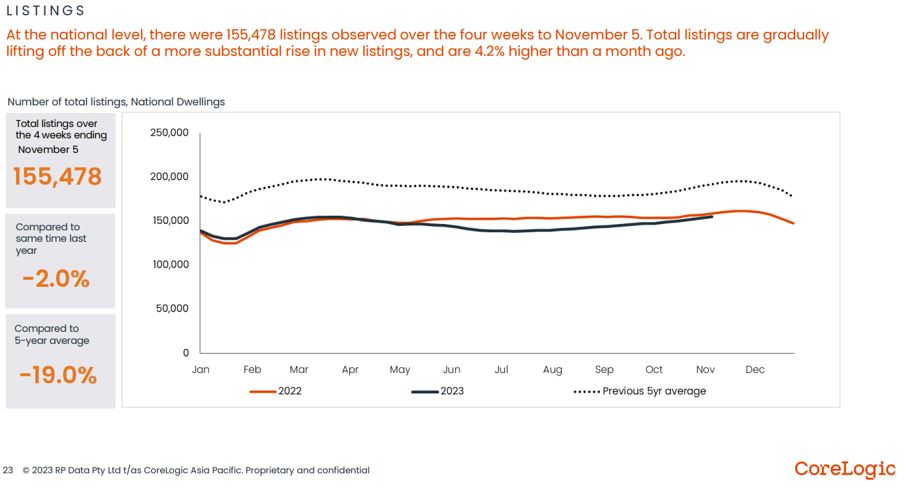

From a supply perspective, the volume of homes for sales throughout 2023 remained at record low levels with stock levels are various stages in certain areas this year reaching nearly 50% below the five year average.

Whilst the number of total listings has increased, they still remain 19% below the previous five-year average nationally.

Let’s take a deeper look into some of the capital cities.

Adelaide

Adelaide median house value: $756,989.

Median unit value: $479,428.

The Adelaide property market has displayed promise in 2023, exhibiting an 8.7% increase since March.

Notably, affordability has been a pivotal factor in its success, being nearly 50% more affordable than the median house price in Sydney.

Even during the last boom, Adelaide’s real estate demonstrated robust growth.

The current tight rental market is evident in its exceptionally low vacancy rates, standing at just 0.3%, the lowest among all the capital cities.

Brisbane

Brisbane median house value: $870,526.

Median unit value: $552,332.

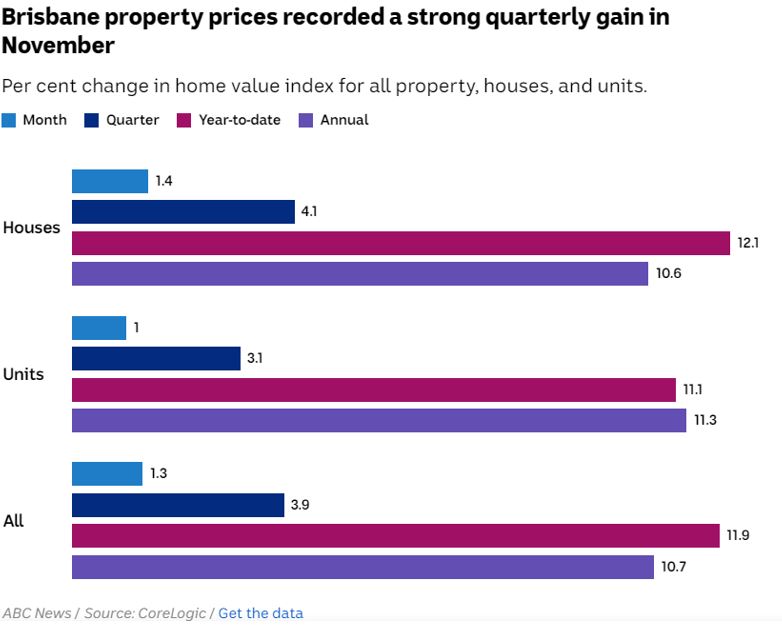

After experiencing a remarkable surge of 45.3% in 2020 and 2021, Brisbane’s property market continued its winning streak throughout 2023.

Over the past ten months, housing values have consistently risen, marking a substantial 10.5% increase since January 2023.

The median house value in Brisbane, standing at just 63% of Sydney’s, underscores a compelling combination of growth and affordability.

This unique blend positions the city as an increasingly appealing choice for investors.

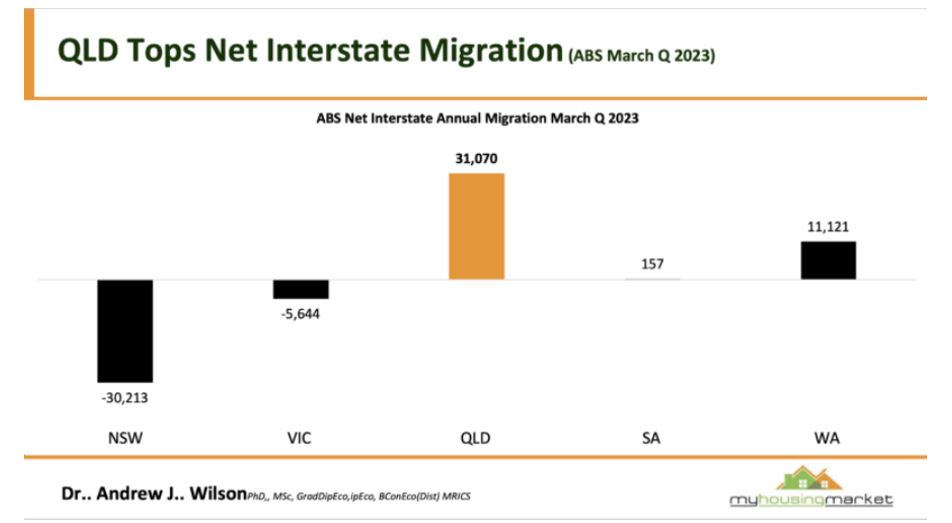

The imbalance between demand and supply is evident in both the sales and rental markets. Notably, significant internal migration, especially from Victoria and NSW, has contributed to this trend, with Australians seeking more affordable properties in lifestyle-oriented suburbs.

In line with these dynamics, federal government forecasts from January 2023 project a growth of over 16% in Queensland’s population by the time Brisbane hosts the Olympic Games in 2032.

This anticipated growth further solidifies Brisbane’s position as a hotspot for property investment.

Melbourne

Melbourne median house value: $943,725.

Median unit value: $610,490.

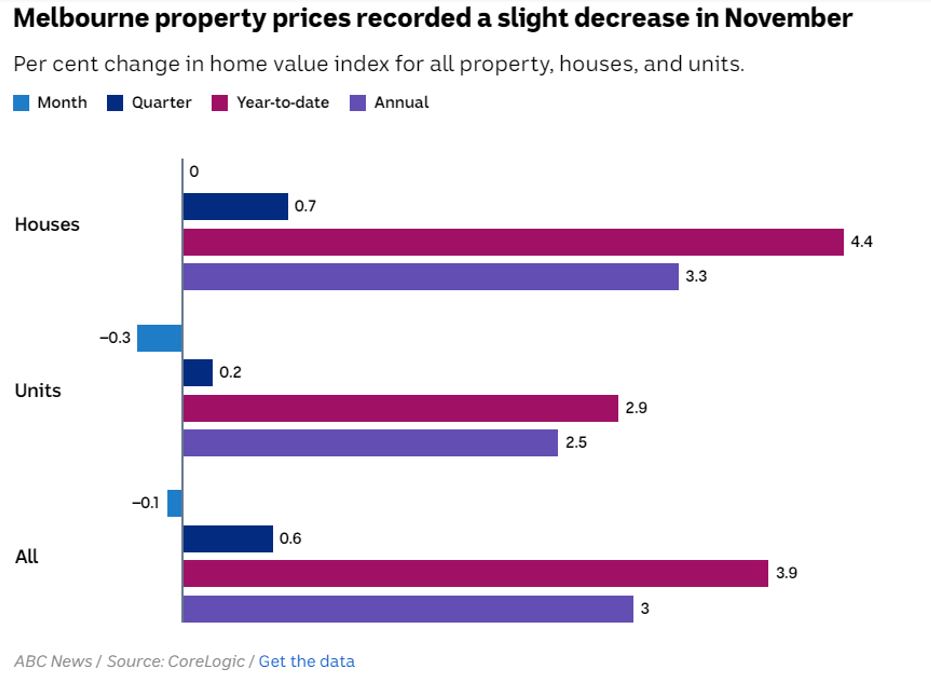

Property investors in Melbourne might not be popping the champagne as their properties have seen modest growth, with values rising just 3% in 2023 and a slight dip of – 0.1% in November.

This subdued performance is influenced by factors such as increasing advertised stock levels, deteriorating affordability, and consistently low consumer sentiment.

Adding to the challenges, Melbourne is witnessing a notable exodus to other states and regional areas within Victoria.

This migration trend is contributing to a cooling effect on the market, creating a complex landscape for property values in the city.

Perth

Perth median house value: $676,910.

Median unit value: $457,296.

It’s full steam ahead for Perth property values, rising 1.9 per cent in November – the largest monthly gain since March 2021.

The annual growth rate of property prices is now up 13.5 per cent, eclipsing that of Brisbane (10.7 per cent) and Sydney (10.2 per cent).

Listings are almost 40 per cent below their five-year average for this time of year.

Such a disconnect between available supply and demonstrated demand has led to homes selling in a median of just 13 days amid market conditions that are well and truly skewed toward sellers.

Sydney

Sydney median house value: $1,397,366.

Median unit value: $836,220.

November witnessed a notable slowdown in the growth of Sydney home values, registering a modest lift of 0.3%, which is less than half the 0.7% gain recorded in October.

This marks the smallest monthly increase since February this year. Despite this, Sydney has maintained an impressive overall result for the year, with a 10.2% increase.

Sydney, being a preferred destination for overseas migrants, is supported by Australia’s robust immigration policy. As discussed in earlier blogs, the nation’s turbo-boosted immigration policy is expected to continue bolstering not only Sydney but several other capital cities.

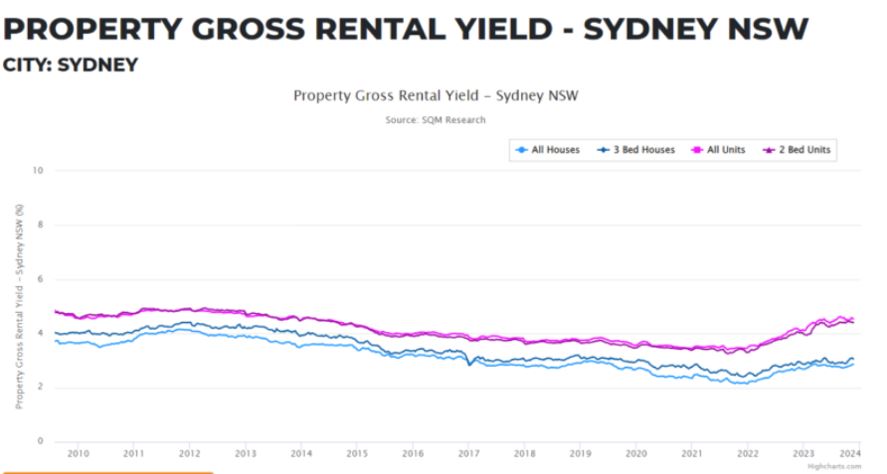

For investors, the challenge lies in perceiving long-term value in Sydney, considering the high entry point and the corresponding rental income. It becomes crucial for investors to be financially positioned to hold the property, given that repayments may surpass rental income.

What Lies Ahead for the Property Market?

As we approach the conclusion of 2023, it’s evident that this year marks the initiation of a new growth cycle in the Australian property market.

At Wealthology, our commitment to in-depth research and vast experience positions us to guide you to areas poised for exceptional value appreciation, outperforming the majority of other regions.

Looking ahead to 2024, we anticipate a two-speed market, where modest growth will be witnessed across many Australian capital cities.

However, key areas are set to experience substantial benefits. Our insights suggest a stable rental market with low vacancy rates and the possibility of interest rate reductions in 2024.

It’s not just about the year that was; it’s about preparing for the promising years ahead.

If you’re considering navigating this dynamic market, Wealthology is here to provide the guidance and support you need to secure your financial future. Explore the opportunities that lie ahead with me anytime – leonie@wealthology.com.au