Can you remember the last time you made $145,000 without lifting a finger? Not many people can. However, Wealthology clients who have followed our advice and invested in one particular area that has skyrocketed… have done exactly that.

Welcome to the Wild Wild West

Now to be clear from the start, the area I’m going to discuss in this blog is Perth.

While Perth’s geographic location might make it seem like a distant investment option, the reality is that Perth has been Australia’s top-performing market over the past 12 months. And the best part? It’s not done yet.

If you’ve been following for a while, you’ll note at the start of 2024, I wrote a blog called” The Australian Capital City Set to Boom in 2024”, and well, it certainly did.

$145,000 in the Last Twelve Months

Perth’s property market is showing no signs of slowing down, recording a 2% rise in values in June and an impressive 23.6% increase over the last financial year. This annual gain translates to nearly $145,000 in added value.

Perth is Still Affordable

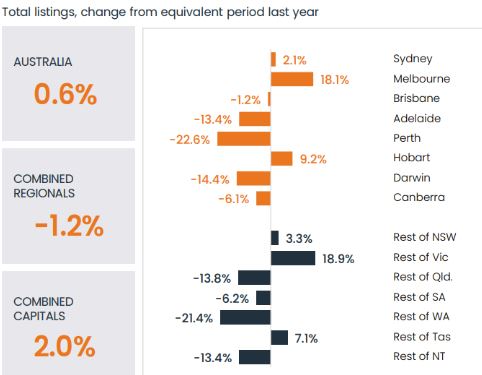

Despite this strong growth, Perth’s dwelling values remain more affordable than eastern capitals. The scarcity of supply is evident, with listings nearly 47% below the previous five-year average.

Take one of our clients, for example, who purchased a new block of land with a house for early $600,000’s. Before settling, the block’s value increased by $85,000. This example highlights the untapped potential within Perth’s market.

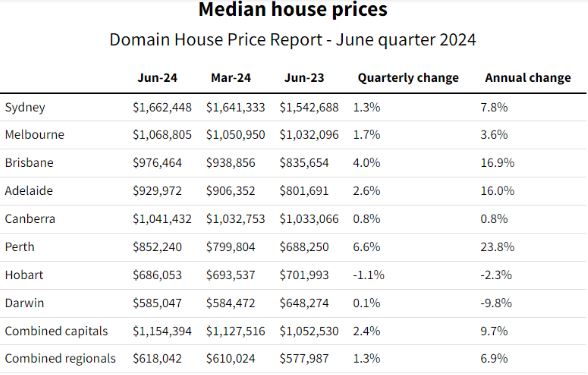

Compared to cities like Sydney, with a median house price of $1,662,448, and Melbourne at $1,068,805, Perth at $852,240 offers significant affordability.

Median House Prices in Australian Cities (June 2024)

Sydney: $1,662,448 (Quarterly: +1.3%, Annual: +7.8%)

Melbourne: $1,068,805 (Quarterly: +1.7%, Annual: +3.6%)

Brisbane: $976,464 (Quarterly: +4.0%, Annual: +16.9%)

Adelaide: $929,972 (Quarterly: +2.6%, Annual: +16.0%)

Canberra: $1,041,432 (Quarterly: +0.8%, Annual: +0.8%)

Perth: $852,240 (Quarterly: +6.6%, Annual: +23.8%)

Hobart: $686,053 (Quarterly: -1.1%, Annual: -2.3%)

Darwin: $585,047 (Quarterly: +0.1%, Annual: -9.8%)

The combined capital median is $1,154,394, showcasing Perth’s relative affordability and growth potential.

Median Days on the Market – Property in Perth Doesn’t Last Long

Property in Peth doesn’t last long, in fact on average only ten days. Yep, that’s right the latest data highlights the national average for median days on market at 34 days, while Perth showcases an impressive 10 days.

This is a clear indicator of the substantial demand and momentum in Perth’s housing market.

To put this into perspective, Perth’s median days on the market is less than half of Brisbane’s 20 days, the second fastest.

Such rapid turnover underscores the market’s strength and the intense competition among buyers. I can’t remember a time in my career where there has been such a demand in a market.

This brisk pace in Perth signifies a thriving market where properties are snapped up quickly, confirming that there is an abundance of confidence amongst buyers and a lack of supply in available properties.

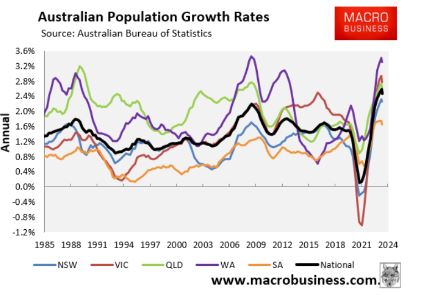

Population Boom Fuelling Growth

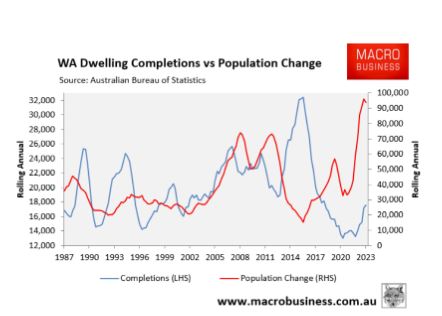

So by now you know that Perth’s property market is currently on fire and is driven by an unprecedented surge in population growth. Western Australia saw a population increase of 3.3% in 2023, outpacing the national average of 2.5%. This boom is largely fuelled by record net overseas migration and significant interstate migration.

Supply is Not Keeping Up

But here’s where it gets interesting: the construction rate is not keeping up. In 2023, WA’s population grew by 93,800, yet only 17,500 new dwellings were constructed.

What does this mean for you? Well, a booming population with a lagging housing supply creates a unique opportunity for property investors. The imbalance between supply and demand is set to continue driving up property values.

It’s Not Only Property Values Increasing in Perth, so are Rentals

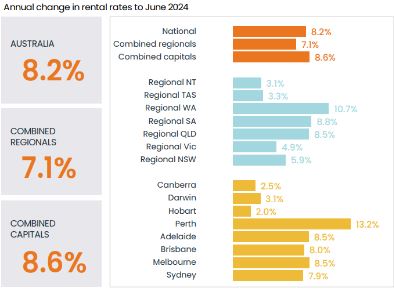

When it comes to rental growth, Perth stands head and shoulders above the rest of Australia. Over the past year, Perth’s rental rates have surged by an impressive 13.2%, far surpassing the national average of 8.2%.

As we approach the end of the blog, you may have read too many numbers, and they may be beginning to blend into one, but this rental growth is a testament to the city’s robust demand and low vacancy rates. Investors are seeing increased returns and enhanced cash flow, making Perth an attractive destination for property investors and adding more heat to the market.

To put this into perspective, while other cities like Adelaide (8.5%), Brisbane (8.0%), and Melbourne (8.5%) also show solid growth, Perth’s performance is exceptional.

It’s Not All Good News!

You’re probably thinking, “I knew it was too good to be true.” Well, you might be right. It’s a tightly held market, and I’ve had to call in favours with those I’ve built strong relationships with over several decades to secure A-grade properties in the region. There is a lot of competition in the market and it’s been challenging. They’re not always available on the day but we do secure them for our clients.

There’s More Opportunity

But don’t lose hope – Perth isn’t our only option. I monitor markets across Australia, and while Perth is a standout, there are other select markets, particularly in Queensland and South Australia, that are poised to perform exceptionally well and represent an opportunity just as good. These areas share similar market dynamics to Perth, offering strong potential for growth.

Take Action Now

It’s more about how much you’re willing to leave on the table before taking action. Let me provide you with a clear, no-cost strategy and outline the exact areas where my clients and I are investing.

Chat with me directly, and I’ll organise a time to explain our approach at Wealthology and show you the properties we are buying and making $$ on.

Speak soon – leonie@wealthology.com.au