The Australian property market has started 2024 with undeniable momentum, akin to an unstoppable force.

Our research team has highlighted some stellar performers as the year kicks off. However, caution is warranted; not all markets are created equal.

Some will likely outperform, while others may remain quieter. Identifying the right market is key to smart investing in the dynamic landscape of Australian real estate.

Momentum Continues in March

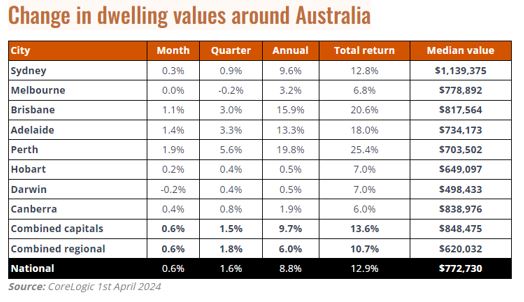

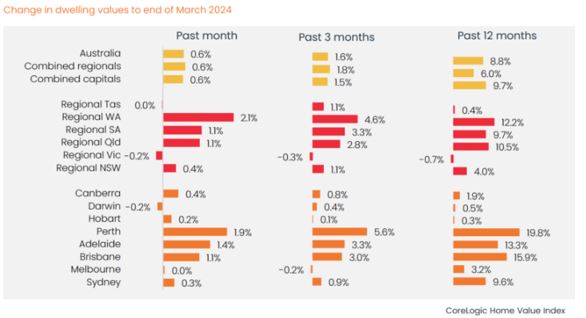

Australia’s housing market has maintained its ascent in March, marking 14 months of consecutive growth with a 0.6% increase in the Home Value Index.

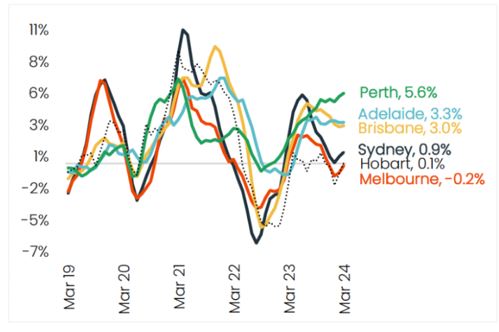

This headline figure belies a more complex picture; the national market is a mosaic of varying performances.

Most capital cities have seen dwelling values climb this month, each moving through its unique property cycle phase, differing from the regional markets.

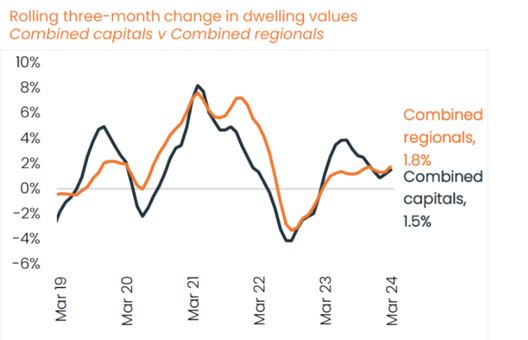

Regional Property Vs Capital Cities

There’s no doubt in my mind that select areas within the regional market are ones to watch and I do have to put my hand up and admit that I thought I’d never say that, but the truth is one of the keys to investing successfully is being able to pivot and be open to opportunities such as investing in regional property.

Now, to disclaim myself immediately, I’m not talking about buying real estate out the back of Bourke.

There is still a long list of fundamentals that need to stack up, and the regional areas I like are small metropolitan cities of their own. Places like Toowoomba, for instance, are interesting markets to keep an eye on.

The reason for my change of heart when it comes to regional property is, quite simply, the world has changed.

Whether it be because of Covid-19 or other factors, people aren’t necessarily locked into having to be near a major CBD.

As these regional hubs have gotten bigger over the past decade, so have the economic factors within these areas to support their growing population and, in turn, stable and strong property growth.

But as always, any type of property must be inline with a well thought out and implemented strategy.

Change in Dwelling Values Around Australia

Brisbane, Adelaide, and Perth have been riding the crest of growth, with Brisbane’s property values up 15.9% annually and a notable 1.1% monthly boost, while Adelaide enjoys a steady climb of 13.3% annually, and Perth leads the charge with a stunning 19.8% yearly surge.

These markets have remained surprisingly accessible. They offer a golden trifecta of affordability, growth, and yield, presenting ideal conditions for expanding portfolios without breaking the bank.

Sydney, on the other hand, has been the dark horse with a median value towering over $1 million, and yet it still manages a 9.6% annual increase. This resilience, I believe, is buoyed by its magnetic pull on international migrants, creating a constant undercurrent of demand.

It feels almost like yesterday when our clients were securing properties in Brisbane, Adelaide, and Perth for around $400,000. Now, they’re reaping the rewards as these markets have shown remarkable growth.

There’s Not One Property Market But Remember To Play the Long Game

As the chart illustrates, Australia’s property markets are diverse, each telling its own story of supply and demand. Perth, for instance, has shined with a 1.9% monthly increase, demonstrating that the right conditions can yield exceptional growth.

Similarly, Adelaide and Brisbane, along with some regional areas, show strong capital growth.

These thriving regions benefit from the perfect storm of lower housing prices and favourable demographics.

However, it’s essential to remember that markets fluctuate, and longevity is key.

Short-term spikes are less important than sustained, stable growth over time. Successful property investment isn’t a quick sprint to the finish line; it’s a marathon requiring endurance and a long-term view.

The details in the provided chart reinforce this perspective, underscoring the importance of a strategic, informed approach rather than reacting to immediate market trends.

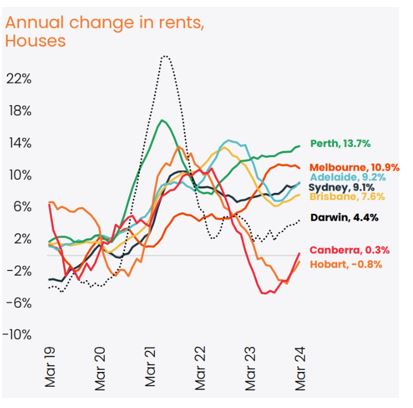

Annual Change In Rents

Australia’s rental market is currently a tight race between limited supply and soaring demand, pushing rental rates higher.

This March quarter saw the national rental index rise by 2.8%, a significant uptick that hasn’t been observed since May 2022’s 2.9% increase.

Surprisingly, Melbourne, often known for modest yields relative to high property prices, has experienced a substantial 10.9% growth in rental rates.

This could indicate a shift in the rental yield landscape or merely a temporary market fluctuation – only time and additional data will tell.

The trend of increasing rents, as the graphic below illustrates, bodes well for property investors, suggesting a boost in cash flow is on the horizon for those with rental properties.

It’s reasonable to anticipate that this upward trajectory in rents will continue, solidifying the cash flow for investors in the foreseeable future.

The Ultimate Question! Where Do I Invest Now?

Finding the ideal investment spot isn’t a quick pick from a single post; it’s a refined skill, sharpened over three decades.

In my view, Brisbane, Adelaide, and Perth aren’t just performing well now; they’re set for sustained growth.

It’s about recognising the specific areas within these markets that are primed to soar.

At Wealthology, we’ve seen this time and again through our clients’ successes.

Want to know which areas will outshine the rest and why? I’m here to unveil the insights grounded in solid data. Reach out to me at leonie@wealthology.com.au for a no pressure and no hassle chat.

Discover more insights on these topics:

- Unlocking the Secrets of Wealth: Lessons Learned from ‘The One Minute Millionaire’ Book

- 3 Essentials You Need To Know About Property Investing

- From Vacancy to Occupancy | 5 Proven Tips to Market Your Rental Property

Leave A Comment