With nearly thirty years immersed in the world of property investment, I’ve fine-tuned my ability to spot undervalued markets set for growth. There’s a particular Australian market now that stands out as a golden opportunity for investors.

This blog post will dissect this market’s data, testing my intuition against hard figures.

Investment isn’t just about predicting which areas will appreciate; it involves a nuanced approach, evaluating potential growth against yields, cash flows, market stability and risk.

Across Australia, numerous properties in poised-for-growth areas await savvy investors. But without a crystal ball, timing the market perfectly is challenging.

Hence, a long-term strategy is vital, allowing you to sustain your investment until the anticipated growth surge occurs.

My earlier discussions on property cycles shed light on navigating these complex dynamics, emphasising the strategic patience required to reap substantial rewards in the real estate market.

Now, drum roll please…

The Emerging Investment Hotspot

Over my tenure as a property investor, I’ve witnessed many market trends, but Perth, Western Australia, stands out as a noteworthy market.

I kept a keen eye on Perth for years, waiting for it to align with my strict investment criteria.

Recently, it has finally passed muster.

My clients, (particularly those invested in South-East Queensland), have seen substantial returns thanks to its stellar performance in the property market.

Property Market Déjà Vu: Recognizing Familiar Trends

This experience allows me to draw significant parallels between Perth’s current state and Brisbane’s position a few years prior, right before it experienced a remarkable price surge of over 30%.

Perth’s market dynamics now show a promising trajectory, making it a very attractive prospect for discerning investors looking to capitalise on emerging opportunities AND to diversify their portfolios.

Affordability Leads to Investment Boom

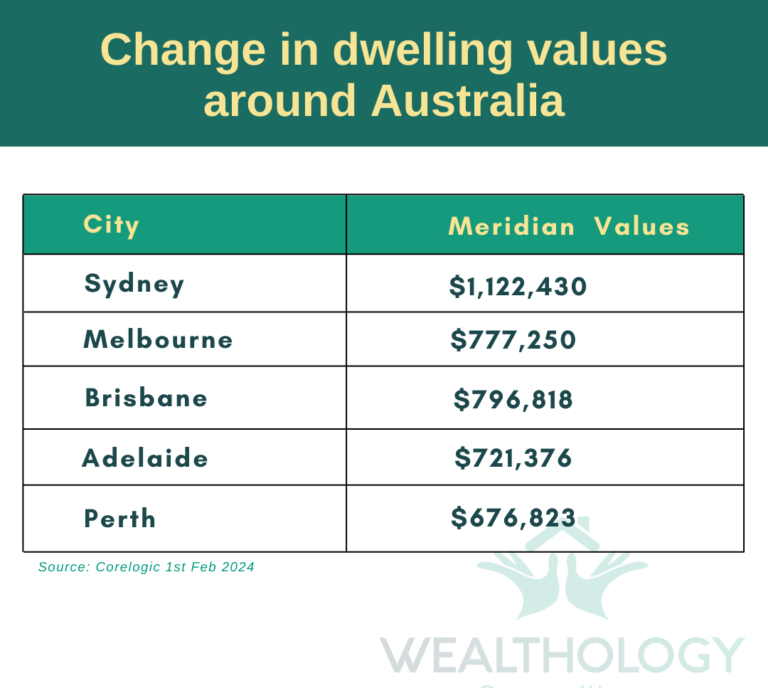

What has made Brisbane so attractive in years gone by has been its price point and affordability, but as highlighted in the table below, we can see that Brisbane’s median value has actually taken over Melbourne. This is great news for our clients who have invested in to the Brisbane market.

You’ll note in the table that Perth now sits as the most affordable city out of the top 5 capital cities.

This attractive price point presents an easier barrier to market for owner occupiers, causing increased demand in the region, whilst many investors with restricted borrowing capacities will also look to park their money in the safety of real estate in markets they can afford, such as Perth.

This affordability also makes it easier for property investors to scale their portfolios.

Rapid Population Growth

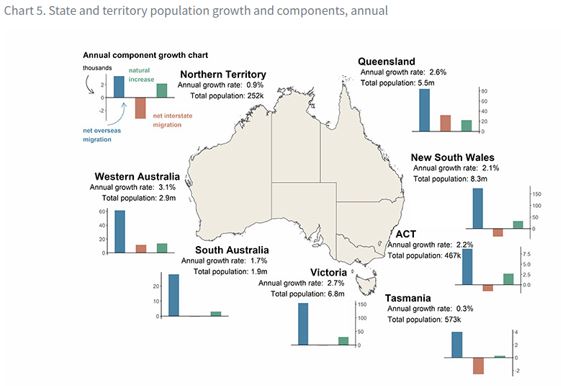

Western Australia (WA) is leading the nation in terms of population expansion, boasting the highest growth rate among all Australian states and territories, as indicated in the graphic below.

This rapid population growth is having a pronounced impact on the property market in WA. The limited number of properties available for sale are being purchased at an unprecedented pace, with the average property spending just 13 days on the market before being sold.

This brisk turnover rate is a clear indicator of the high demand for housing in the state.

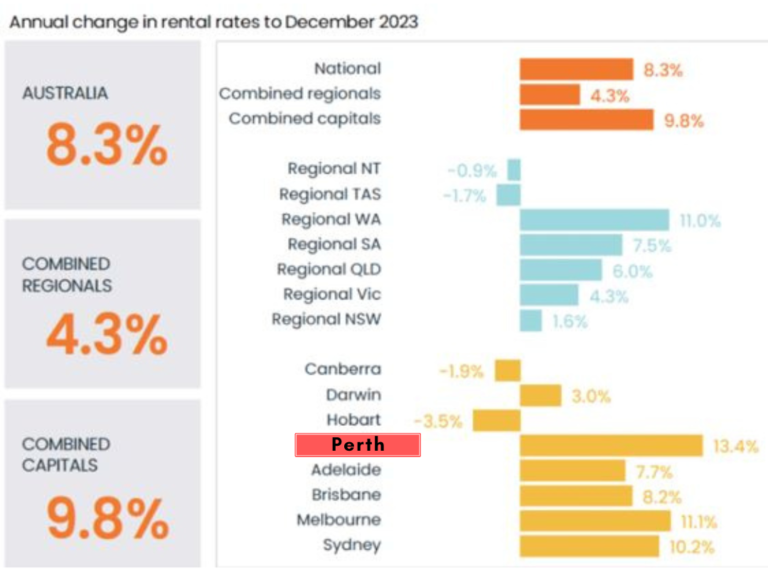

Rents Are Rising Sharply

The surge in population is also straining the already tight rental market. Recent figures from the Australian Bureau of Statistics (ABS) highlight WA’s rental market growth rate at 3.1%, the fastest in the country.

This scenario mirrors our experiences in Queensland post-pandemic, where an influx of new residents from southern states led to a similar tightening of the housing market.

Our clients have witnessed firsthand the impact of population growth on property values.

Just as we saw in Queensland, where the arrival of new residents spurred a rise in property prices, WA is very likely to experience comparable trends.

Understanding the correlation between population growth and property market dynamics is crucial for investors.

Our experience has shown that regions undergoing significant population increases tend to see appreciating property values, making them prime targets for investment.

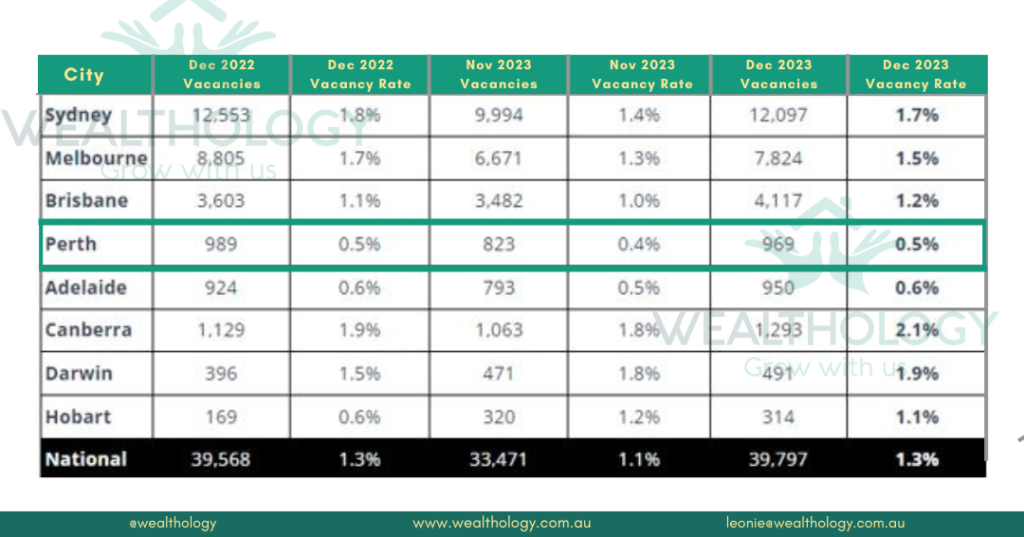

Tight Rental Markets Add Security for Property Investors

The Perth rental market is currently experiencing an unprecedented tightness, with the median dwelling rent reaching a record high of $600 per week by the end of December marking a:

- 4% increase from $580 at the end of September and a significant

- 4% jump from $520 at the end of December 2022.

The situation is even more pronounced in the housing sector, where the median weekly rent for houses climbed to a new peak of $620, reflecting a:

- 3% rise over the quarter and a

- 7% increase over the year.

This tightening of the rental market is incredibly advantageous for property investors. Drawing parallels with the Queensland market, similar constraints led to a dramatic surge in rental prices there as well, reinforcing the security and profitability of investments in such environments.

Low vacancy rates in Perth further bolster the stability and potential returns on investments, ensuring that properties are rarely left unoccupied and income streams remain consistent.

Available Land Shortage

While I’ve shared plenty of positive news, there’s a caveat that may not favour everyone: the opportunity for premium acquisitions in the market is fleeting.

The patterns are all too familiar, and Perth is currently showing all the signs of a market heating up. Although the potential for growth extends far into the future, the prime time for acquisitions is narrowing.

On The Ground Analysis

On-the-ground observations are already indicating rapid changes; land developments are selling out in a matter of days, land registration timelines are being pushed further out, and developers are even considering the introduction of ballots to manage the overwhelming demand for land plots.

This urgency underscores the need for timely action if one wishes to secure valuable investments in this market.

It’s Time to Act

As you’re aware, I’m not one to resort to pressure tactics; instead, I prefer to rely on presenting clear data and undeniable facts. It’s clear to me that Perth’s market is on an upward trajectory and is currently leading the growth among Australia’s capital cities for 2024.

For those clients who have seen significant success in Queensland, this presents an ideal opportunity to diversify your investments and capitalise on other markets showing great promise.

The evidence is compelling, and historical trends often provide a roadmap for future outcomes, indicating a prosperous phase ahead for Perth.

However, as I’ve previously noted, the opportunity to secure premium investments in this market is limited due to its rapid heating.

My three decades of market analysis reinforce that the time to act is now.

I invite you to get in touch for a no-pressure discussion about the Perth market and to explore the specific opportunities that Wealthology clients are currently seizing.

Feel free to reach out at leonie@wealthology.com.au for more information.

Discover more insights on these topics:

- How to Calculate Your Ideal Passive Income for Retirement

- Knowledge is Key: The Top 4 Books to Read for Property Investment Success (was titled Recommended Reading for Those Wanting to Master Money)

- Mind Over Money | Master Your Mindset to Be a Successful Property Investor