Heya property lovers, It’s Leonie here, and well, I officially feel OLD! Writing this blog today has seen me reminiscing about property cycles and how this market feels all too familiar.

Not to give away my age, but I have been an investor in Australian real estate for more than three cycles. I have witnessed many ebbs and flows in the real estate market, and I have learned that rising rents, property prices, and interest rates are not isolated events.

Instead, they are like the intricate gears of a clock, each playing a crucial role in the market’s overall performance.

As an investor, it is essential to understand how these gears work together, for they can create a perfect storm of opportunity for those who know how to navigate it.

The State of The Rental Market

The rental market in Australia is currently in a state of crisis, with record-low vacancy rates and unprecedented annual rental increases in its capital cities.

The pressing issue at hand is the mismatch between the supply and demand of rental properties, which is pushing the prices upwards.

Whilst this is not great news for renters, landlords are licking their lips.

No New Rental Listings

In the past four weeks, the total supply of capital city rental listings was a staggering 20.9% below the level recorded a year ago and 39.8% lower than the five-year average.

This is represented in the data by CoreLogic which highlights the combined annual rental increase of 11.7% in the past year which is an all-time record.

There’s no good news for renters as more data obtained outlines the construction of new homes is also dramatically down, adding further constraints to the already troubled rental market.

No New Homes are Being Built

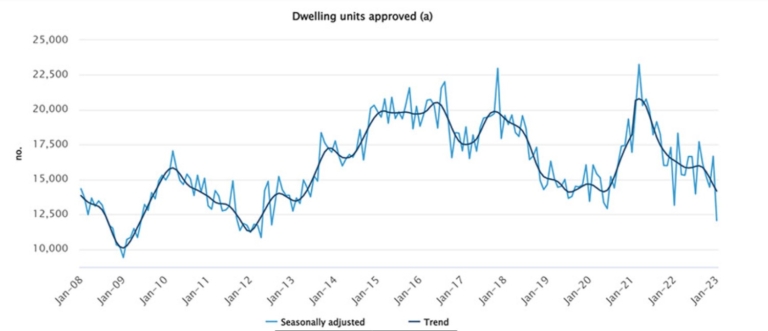

The number of unit dwelling approvals in March was 17.3% lower than in March 2022, with only 12,686 new dwellings approved. The construction of new private sector houses was also down, with a 2.8% decrease from February and a 15% decrease from March 2022.

The situation is further compounded by the upcoming half a million people coming in the next year or two, all of whom need a place to live.

The Governments Silver Bullet

The government’s solution to put a cap on the amount landlords can increase their rent is a short-sighted one. It disincentivises property investors from buying, taking additional supply out of the market and causing the problem to exacerbate.

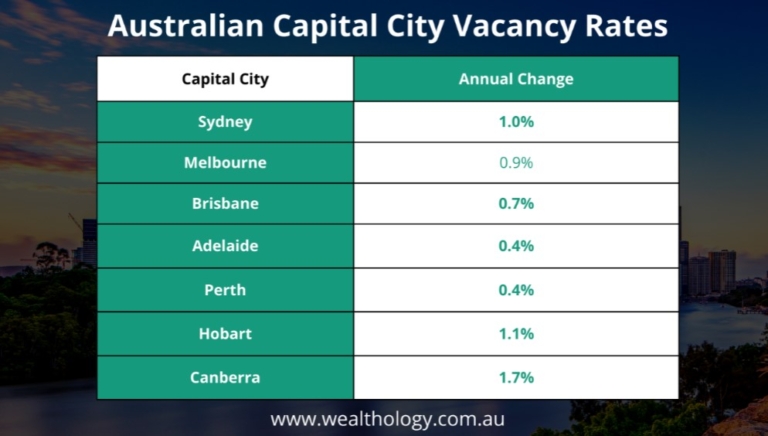

Vacancy Rates

With all that being said, it’s no surprise that vacancy rates remain at historic lows; Sydney (1.0%), Melbourne (0.9%), Brisbane (0.7%), Perth (0.4%), Adelaide (0.4%), Hobart (1.1%), and Canberra (1.7%) remain at a record low.

Across the combined capitals (0.8%) and combined regionals (0.9%), vacancy rates are lower than the historical average.

For perspective, it’s important to know that a balanced rental market is considered to have a vacancy rate of 3%, therefore signifying significant pressure on supply in these markets.

Yields on the Rise

After considering all of the above, the rental market is in for an extended period of undersupply that could extend perhaps another two years.

Nevertheless, we’ve seen Wealthology clients see 20% increases in their rental income in the space of twelve months, providing a handy boost to their cash flow.

Property Prices Are Back on the Rise!

To those who predicted a property crash, I am not surprised to see that it hasn’t happened.

The property market is the cornerstone of Australia’s economy, holding the majority of its wealth.

But what you may not know is that this has been one of the most predictable property cycles in recent history.

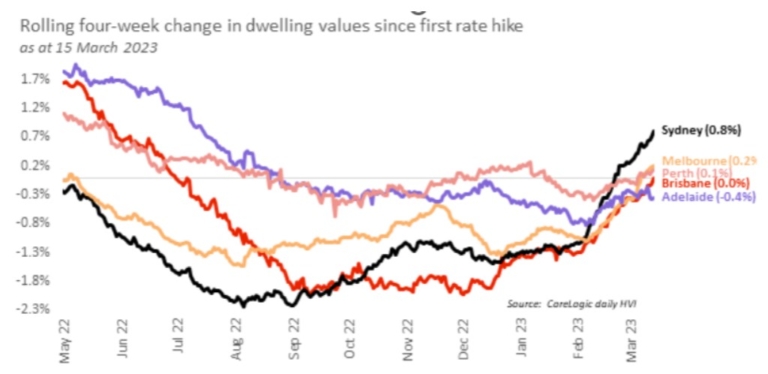

In a blog post, I wrote about property cycles, laying out the stages and how they progress. And right now, we are in the “recovery” phase, where vacancy rates drop, yields rise, and property prices steadily grow.

It’s true, vacancy rates have dropped, yields are rising, and property prices are steadily growing. In fact, the median capital city house price has increased for eight consecutive weeks, as I detailed in a recent blog post.

But what I’ve observed in my three decades of experience is that Aussies love to jump on the bandwagon, especially when it comes to property investment. So many investors shy away from a declining market out of fear, but as soon as they see those green arrows, they come out of the woodwork, causing a snowball effect of demand and a price rush.

So, to those waiting for the crash, I’m afraid to say that it’s not happening anytime soon.

The Australian property market is thriving, and the latest rise in interest rates may be the final ingredient needed!

Interest Rates Rose Again – But Here’s Why It May be a Good Thing

In what some may deem a bold move, the Reserve Bank of Australia has implemented another interest rate rise to curb inflation.

While some may have been caught off guard by the decision to raise interest rates last month, and there may be potential impacts for some households, this could present an opportunity for progress.

The mere threat of an impending interest rate rise may have put more pressure on households than the interest rate rise itself.

You see, simply facing the fact that interest rates can’t rise forever enables you to understand that these rises in rates are merely a momentary factor in the market.

Many economists, including those at the major banks, believe that we have now seen the last of interest rate rises and that we’ll start to see rate cuts heading into 2024. CommBank, NAB and Westpac believe that the cash rate will peak at 3.85%, which is where it sits currently, before falling at some stage throughout the back half of 2023 and 2024.

To paraphrase from a previous blog, “Like water in a kettle, demand is slowly bubbling away as people put off purchasing due to fear of interest rates. With every day passing, more water gets added to the kettle, and the flame beneath it intensifies”.

Interest rates will stabilise, which will do wonders for consumer confidence. Consumer confidence is already showing signs of an increase, with confidence rising 1.8pts in April.

Now is the time to act and secure your financial future! Don’t let fear hold you back from implementing a winning strategy. With careful consideration of the factors I’ve outlined, you CAN confidently decide to invest in your future.

This small window of opportunity won’t last forever, so act now and take advantage of the potential for lower prices and increased cash flow.

Reach out to chat ideas and strategy – leonie@wealthology.com.au