Prospective property owners in Sydney have gone from fearing they’ll miss out to fearing they’ll overpay.

Sydney house prices could drop dramatically

There’s certainly no doubt that over the past two years Sydney property owners have been on one hell of a ride with property prices rising over 30% in the twelve months leading up to December 2021.

Certainly, a great result but for those who were hoping that the good times were going to keep on rolling, it’s time to wake up.

Price growth in Sydney looks to be over with Commonwealth Bank Of Australia forecasting that by the end of 2023 Sydney’s median dwelling price could drop by $150,000.

It seems that prospective purchasers agree. We’ve dug up some data to confirm that prospective purchasers in Sydney aren’t as eager as they may have been six months ago, as clearance rates have noticeably dropped – almost 20% when comparing data from October 2021 to March 2022.

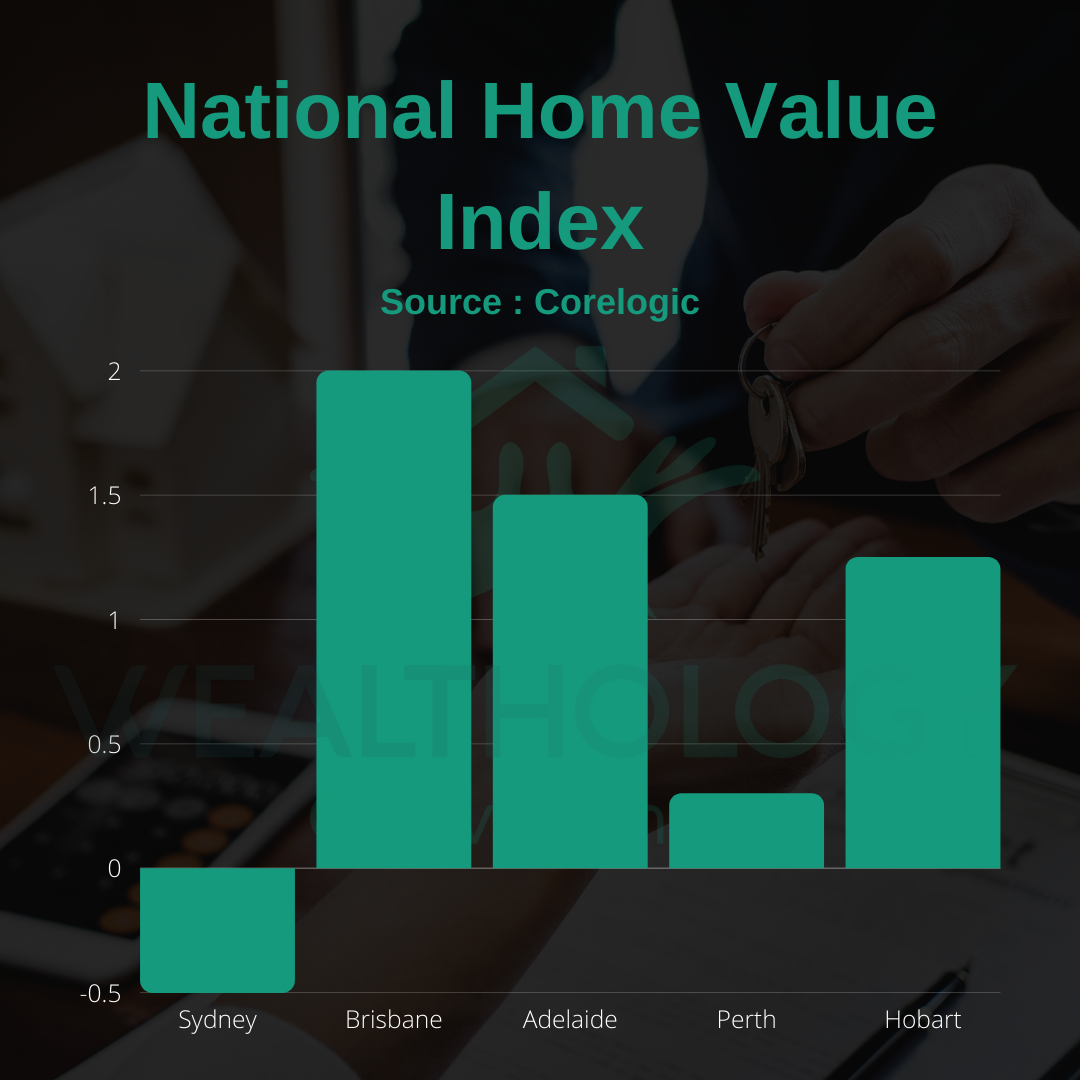

Prices in Sydney have already started to decline according to CoreLogic’s national home value index (pictured below). This signifies a dramatic change in the dynamic of the market.

Sydney house prices rose approximately 10 times more than wages

Even with this decline in property prices, the “Australian Dream” of owning a home will still be out of reach for many first home buyers in Sydney. To offer our readers a perspective of the challenges faced in the Sydney market, last year property prices rose approximately 10 times more than wages. Understandably first home buyers in the southern states are left wondering if they’ll ever be able to purchase a home.

All of this equates to more stock on the market and fewer buyers which will weigh down prices.

Data suggests that listings are up 5% as property owners try to cash in on the recent boom whilst it’s estimated the buying pool is significantly smaller than it was at the back end of last year.

The right guidance always provides opportunities for investors

It ist’s important to remember that the Australian property market doesn’t move at the same pace. Within the overall Australian property market, there are quite literally 100’s of micro-markets meaning with the right guidance there are always opportunities for investors.

Understanding this is crucial to expediting your wealth creation and allows you to continue to grow your portfolio’s value despite what might be happening in Australia’s major city.

The opportunity right now is in Southeast Queensland. Interstate purchasers from Sydney and Melbourne are flocking in droves to purchase property in Brisbane and surrounding areas. The data confirms that last quarter Brisbane had the steepest hike in property prices in almost two decades resulting in a 10.7% increase in prices.

Queensland and Brisbane have experienced the strongest population growth in the nation thanks to strong migration from Melbourne and Sydney. The increased migration is expected to continue over the long term according to the Australian Government’s population statement meaning sustained growth is likely.

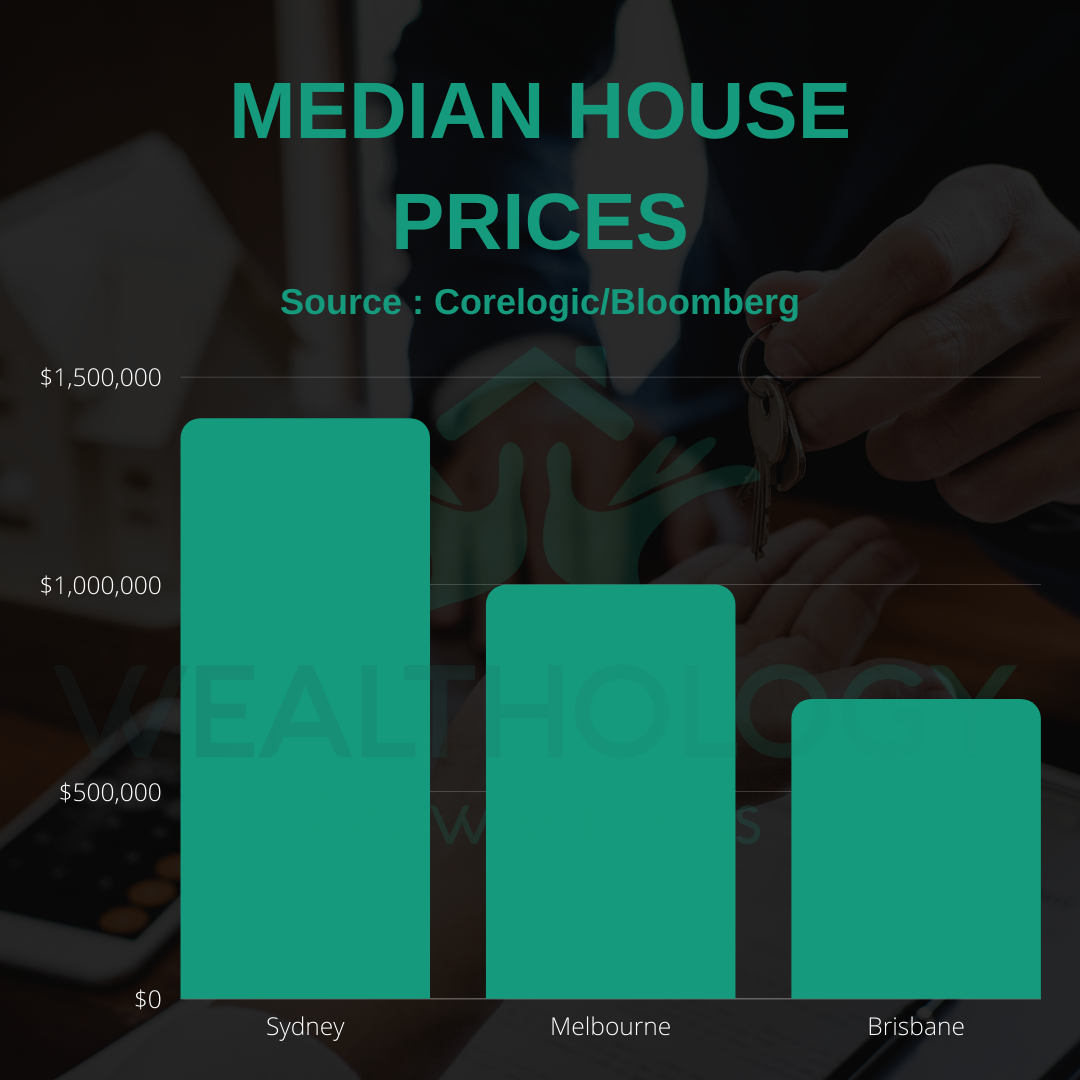

Interestingly, Domain.com also indicated that over a quarter of all enquiries on Brisbane property was from interstate purchasers. The value is there for all to see with Brisbane’s median house price considerably less than our southern counterparts.

Brisbane property market still has momentum and will continue to grow

Despite the recent floods, the Brisbane property market still has momentum and will continue to grow over the longer term. The total number of homes for sale is still at record lows and there is still simply not enough stock to keep up with demand.

In addition, Brisbane’s property market will face little resistance in the way of an interest rate rise due to its relative affordability and a rise in rates will further escalate the mass exodus of the southern states into more affordable areas.