Dreaming of becoming a homeowner? Hold on to your dreams, folks, because the reality may be harsh.

In certain areas, the answer to your house-buying aspirations is a resounding “No!” And no, it’s not due to exorbitant prices or higher interest rates.

The reason is quite simple yet unbelievably frustrating: there are no houses for sale. Yes, you read that right – none, nada, zip!

It’s a situation where the real estate market has taken a temporary hiatus, leaving potential buyers in a state of bewilderment.

But there’s one type of person who is the main beneficiary of all of this.

And well, even if you’re looking to rent a house, you’ll struggle with that too.

So, what’s the answer?

Scarcity Grips the Market as Buyers Outnumber Sellers

Ah, the Australian love affair with real estate! It’s a resilient market that seems to weather any storm thrown its way.

Even in the face of consecutive interest rate rises, property prices continue to climb, as we discussed in one of our recent blogs on Australia’s property price growth.

The markets are truly heating up, with some areas experiencing significant price surges.

The underlying reason behind this upward trend is the severe shortage of homes for sale, creating a situation where more buyers are vying for properties than there are sellers willing to part ways with their homes.

Now, let’s talk about some intriguing examples of this scarcity. I must emphasize that these areas I’m about to mention may not be the ones I’d recommend, but they do pique our curiosity.

For instance, if you had your heart set on purchasing an apartment in South Australia’s Barossa, Yorke, or Mid-North, I regret to inform you that luck is not on your side.

Data from Domain reveals that not a single unit has been listed for sale in the past 12 months in those regions.

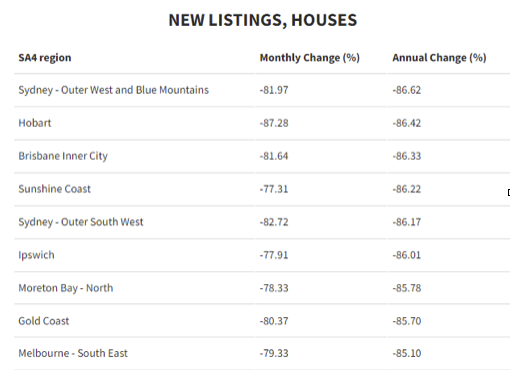

Let’s shift our focus to Southeast Queensland. Brace yourself for some staggering figures:

Brisbane South has witnessed an 88.15% decline in listings. Brisbane East follows closely behind with an 87.58% drop, Brisbane North experiences an 86.67% decrease, Moreton Bay observes an 85.78% decline, and Ipswich is down by 86%.

The primary cause behind this supply blockage lies in the reluctance of sellers to put their properties on the market. They are apprehensive about finding a suitable new home that meets their needs.

Brisbane South, for example, continues to offer scarce options.

In the past month alone, it has seen a meagre 51 new listings, a staggering 88% decrease compared to the previous year and an 83% decrease compared to the previous month.

A Glimmer of Hope for Tenants: Rental Vacancy Rates Show a Slight Uptick but More Pressure to Come

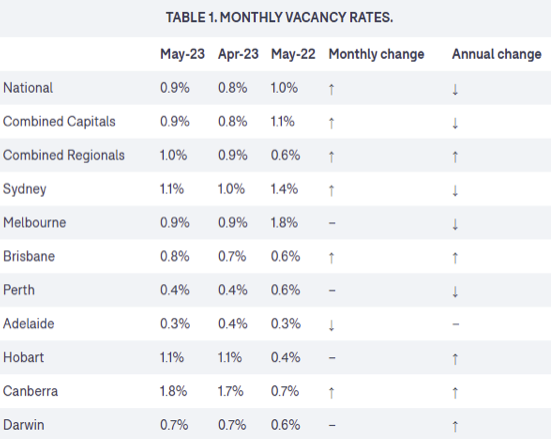

In a glimmer of good news for tenants, Domain reports a positive development in the rental market.

According to Domain’s May Rental Vacancy Rate Report, the national vacancy rate has inched up to 0.9%, breaking the trend since December 2022, when it hit a record low of 0.8%.

This increase marks a noteworthy milestone, as it is the first monthly rise seen since October 2020.

Various cities have witnessed improvements, with Sydney (1.1%), Brisbane (0.8%), Canberra (1.8%), and the combined capitals (0.9%) and combined regionals (1.0%) all seeing their vacancy rates grow.

It’s a positive sign that cities are gradually moving away from their record lows.

While Melbourne (0.9%), Perth (0.4%), Hobart (1.1%), and Darwin (0.7%) maintained stable vacancy rates, it’s essential to note that rental listings remain significantly lower compared to last year, with Melbourne at -46.7%, Sydney at -15%, Perth at –23.7%, and combined capital cities at –21.3%.

This indicates an ongoing shortage of rental housing.

Furthermore, the pressure on rental markets is expected to persist due to the government’s plans to welcome over 700,000 immigrants in the coming years.

The continued inflow of international migration, coupled with an unclear strategy for constructing new homes and supporting infrastructure, implies that this temporary relief may be short-lived.

Weekly Rental Amounts Rising Across the Country

While vacancy rates show a slight improvement, rental prices continue their upward trajectory.

Australian capital cities have witnessed their most substantial annual rent increases to date, intensifying the already precarious housing crisis.

Rent amounts have soared across the country, with over 40% of suburbs recording rental hikes of 10% or more in the past year.

Unsurprisingly, Sydney retains its title as the most expensive city to rent in, with the average weekly rent surging by 1.2% to reach $723.

Canberra follows closely, experiencing a slight decline of 0.4%, with a median rent of $671.

Brisbane saw a 0.6% increase, with the median rent at $609.

Melbourne, despite a 1.4% spike in median rent to $543, still lags behind Perth ($594) and Darwin ($596) in terms of rental costs.

There’s Only One Man Who Can Save Us – Well Maybe Not

Ah, behold Mr. Anthony Albanese, our so-called almighty saviour (yeah, right), with his much-touted announcement of a one-off $2 billion social housing plan.

Supposedly, this plan aims to ensure that every Australian is blessed with the luxury of having “a roof over their head.” How noble, you might think.

Under the guise of the new Social Housing Accelerator scheme, state and territory governments will receive funds within the next two weeks to construct an additional 9,000 social homes.

Now, 9,000 homes may sound like a substantial number, leading one to believe it could finally address our housing shortage problems. But alas, my friends let me burst that bubble of optimism.

Recent demographic data from the Australian Bureau of Statistics (ABS) has revealed the stark reality of the situation. Australia’s housing crisis, fueled by unprecedented population growth driven by immigration, remains far from being “solved’.

Take a look at the chart, displaying a staggering surge of 497,000 in Australia’s population during the calendar year of 2022, primarily attributed to a record net overseas migration of 387,000.

These figures highlight the astonishing need for approximately 329 new homes per day to accommodate migrants alone.

So, dear Mr Prime Minister, we express our gratitude for providing us with a grand total of… drumroll, please… 27 days’ worth of housing stock. Bravo.

None Of This Is Bad News For Property Investors

In conclusion, amidst the challenges faced by many, there’s one group poised to reap the benefits -the savvy property investors.

Yes, that might just be you (wink wink).

The scarcity of supply in the market inevitably drives property prices skyward, and they’re already on the rise.

The influx of people flocking to Australia is simply mind-boggling, setting the stage for a lucrative property cycle that promises substantial gains for investors.

While interest rates may currently pose a thorn in your side, take solace in the fact that they are inching closer to their peak or may have already reached it.

As rents continue to climb, I strongly believe that borrowing costs will soon decrease.

For those sitting on the fence, contemplating an investment, now is the time to act. But be swift, for the window of opportunity is gradually closing as more individuals catch on.

Don’t hesitate to reach out to me personally at leonie@wealthology.com.au, as I’m here to provide guidance and assist you in capitalising on this promising market.