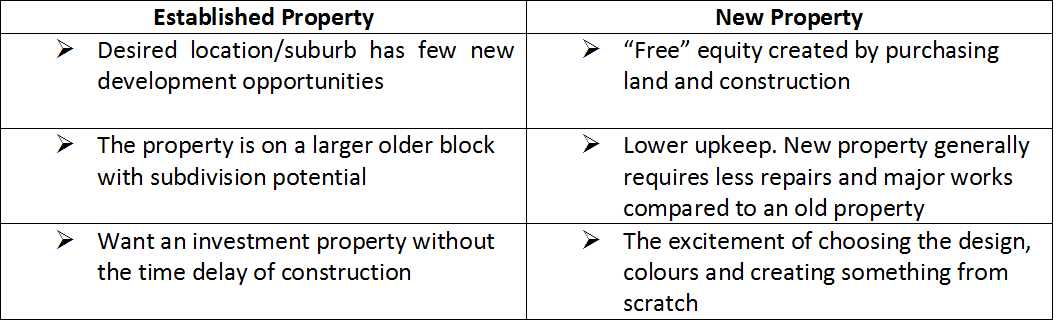

When it comes to purchasing an investment property, there is few things more divisive than the argument of buying established or building new.

You may resonate with some of the reasons investors choose old or new properties below –

But what does the tax man say? Is there a difference in the tax treatment of old and new properties for tax purposes?

Depreciation Changes (Div 40)

The answer is yes, particularly after the 2017 Federal Budget announced changes to depreciation claims for 2nd and subsequent owners. If you are unsure what has changed, here is a brief re-cap on the depreciation changes effective from 9th May 2017 –

- Income Tax Deductions for depreciation (capital allowances or otherwise known as decline in value) of plant & equipment in residential rental properties are no longer allowed.

- The new rules apply to deductions for depreciation from 1 July 2017 for 2nd hand plant and equipment acquired after 7.30pm on 9th May 2017.

- The purchase of new plant & equipment (e.g. when doing a renovation or constructing a new property) will continue to be able to claim depreciation.

- The changes do not affect the capital works / building write-off (Div 43 deductions) which applies to the construction costs.

What this means – purchasers of established or second-hand investment properties will no longer be able to claim a tax deduction for the decline in value of plant & equipment (e.g. air conditioners, dishwashers) as previously done.

The Government announced a handful of other changes affecting property investors in the 2017 Federal Budget, read more about them here in our 2017-18 Federal Budget blog.

Building Allowance (Div 43)

Deductions for construction costs is the other significant tax difference between new and old properties.

Construction costs of a residential building and any structural improvements may be tax deductible over 40 years under Division 43 ITAA 1997. We utilise a quantity surveyor to determine the construction costs eligible and certify the cost as at the date installed and completed.

As building allowance deductions start from when the property was completed, the newer the property the greater the building allowance deductions you as the investor will have.

Example 1 – An older property built in 1976 would not be eligible for any building allowance deductions unless renovations had been undertaken after 1992.

Example 2 – An owner of an investment property with eligible construction expenditure of $240,000, will be able to claim $6,000/year ($240,000 x 2.5%) in building allowances.

Since the 2017 Federal Budget, the denial of capital allowances (depreciation) on second-hand plant & equipment in investment properties, has significantly affected the desirability of established properties. However, understanding the deductible amounts a property has available, will let you know the full cashflow picture of the property.

Income tax outcomes should never be the main driver in selecting an investment option, instead factors such as cashflow from rental and future capital growth should. However, the tax outcomes and cashflow generated by it, can be fairly influential.

If you are considering purchasing an investment property, we can help you review what the tax and cashflow outcomes will be as well as determine the most appropriate ownership structure for your circumstances.

Feel free to contact myself or one of our qualified accountants in the tax team to discuss your property purchase further.

Ph. 07 3849 3816

Email: tax@goadaccountants.com.au

Principal of Goad Accountants and Simply Business Bookkeeping. Karen is a Chartered Accountant and Certified Tax Adviser with over 19 years of experience advising small to medium business, helping them know their business through accurate record keeping, tax advice, KPI monitoring and profit improvement strategies. Goad Accountants are specialists in property tax for investors and developers helping them get the most out of their property portfolios.

Disclaimer: The information contained on this website is general in nature and does not consider your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. Taxation, legal and other matters referred to on this website are of a general nature only and are based on Goad Accountant’s interpretation of laws existing at the time and should not be relied upon in place of appropriate professional advice. Those laws may change from time to time.

Follow Goad Accountants on Twitter or Facebook