For as long as people have been investing in property there has been a common question. Should you buy a property for its capital growth potential, or should you buy a property for cash flow?

With an interest rate rise potentially on the horizon many investors are revisiting this age-old debate, to gear negatively or positively.

I want to address a glaring issue immediately that may be prudent for some of you and that is; if the news of a potential interest rate rise has you losing sleep or wondering how you will address increasing repayment shortfalls on your investment property loans you might like to get in touch. The chances are your portfolio is structured all wrong.

How to Structure Your Portfolio Correctly

Your portfolio needs to be structured in a way that allows you to still purchase and hold quality assets over the long term regardless of interest and inflationary rates. Throughout a property cycle which can be between 7-12 years your portfolio needs to be able to endure changes in circumstances such as; interest rate fluctuations, rise/drop in rental income, rental vacancy, short term loss of employment and more.

This brings me to the original question posed at the beginning of the blog… “Is cash flow really king”?

A profitable balanced portfolio understands the fundamental relationship between capital growth and rental yields. It’s crucial to your investing success that your portfolio is balanced to ensure that you can continue to hold performing assets over the longer term.

A Common Mistake Investors make

I’ve seen investors make the mistake of chasing huge rental yields in property markets that don’t have the solid foundation of infrastructure that supports long term property performance and eventually end up holding a property that they quite literally can’t afford to sell.

I’ll give you an example of one couple who bought a property in Mackay in North Queensland at the height of the mining boom. They purchased a 4-bedroom brick home for $425,000 which at the time was rented for a whopping $780 per week, equating to almost 10% gross rental yield. Impressive right?

That same property, just 24 months later was now worth $300,000 and had been vacant continually for almost 5.5 months. Eventually the landlord had to drop the rent substantially, down to $240 per week. On the back of the mining meltdown of 2015, unemployment rates in the area doubled, thousands of people left the area and 3,000 homes were listed for sale in a matter of months.

A devastating result for the property investor.

I tell you this story to emphasise the fact that whilst cash flow is great I don’t believe it is necessarily “KING”.

Yield vs Cashflow.

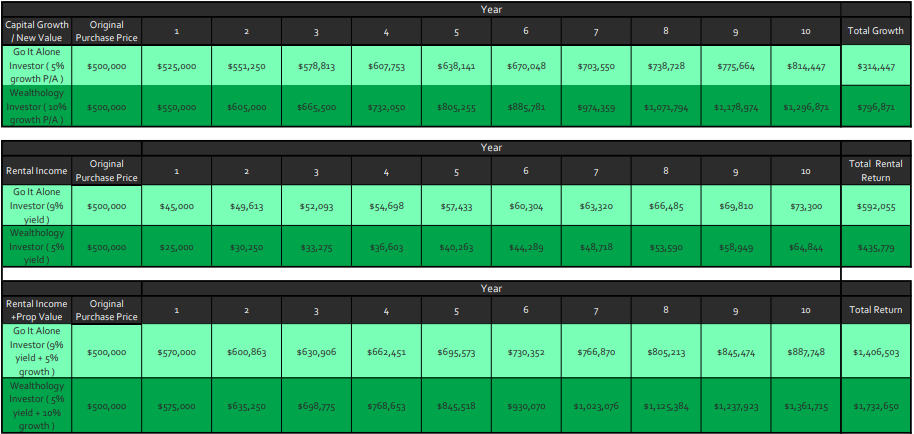

For instance, I’ve created a table outlining the effects of choosing a property purely from a cash flow perspective. If you purchase a property for $500,000 that yields 9% pa with 5% growth, after 10 years that property will be worth $814,447 and provide an income of approx.. $73,400.

In comparison, a property bought for $500,000 that produces a 5% yield (current average return), and a capital growth rate of 10% each year for 10 years, will be worth $1,296,871 and yield $64,844 pa.

The high-growth property is worth almost 3 times what it was initially purchased for and is now reaping only slightly less cash flow than the property initially purchased for a high yielding return.

It’s a fine line balancing a portfolio, making sure you have a sufficient mixture of growth and cash flow is key. We’d always recommend a property that has a greater opportunity for capital growth as well as ensuring that it provides enough cash flow to make investing comfortable.

On top of this, our method allows our clients to benefit from compounding equity, which instantly provides a built-in financial buffer to offset higher loan repayments. Higher equity also means you can add to your portfolio sooner, allowing you to expedite your long term goals and plans.