If you’ve been relying on a fortune cookie to tell you the perfect time to invest, save yourself the $100 overpriced sweet and sour pork and listen in.

Today, I’m going to give you the full rundown about what factors in the marketplace fill me with confidence and excitement about the state of the property market and its upward trajectory into the future.

The Looming Shortage

The Australian property market is navigating a severe housing shortage, a situation that is expected to persist well beyond 2024.

I highlighted this impending crisis over a year ago in my blog “Australia’s Fast-Growing Population – Housing Crisis Ahead?” and, unfortunately, we are now experiencing the full impact of this shortage.

This shortage, driven by various factors, is expected to significantly influence both house prices and rental markets in the upcoming years.

Current construction rates simply aren’t keeping up with our booming population, as evident from recent data.

Apartment Construction No Solution to Housing Shortage

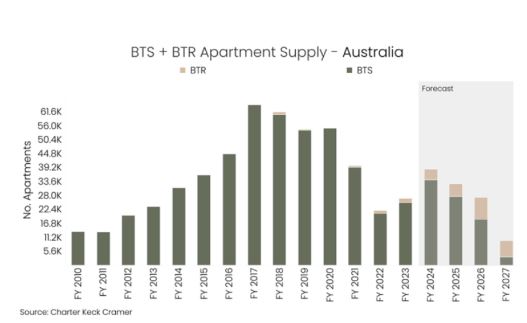

Australia’s housing market has long suffered from an under-supply issue. A brief respite was provided by a high-rise apartment boom from 2017 to 2020, but those opportunities are dwindling.

Projections now suggest that apartment construction could fall to levels last seen in 2010, exacerbating the existing gap in housing availability.

This trend points to significant challenges ahead in meeting the housing needs of Australia’s growing population.

The government Planned to Build 1.2 Million New Dwellings. So Where Are They?

The Australian government has announced plans to build 1.2 million new dwellings over the next five years, emphasising medium-density and high-rise apartments as critical to solving the housing shortage at scale.

However, builders face significant challenges: material costs, although down from their peak, remain high; the construction industry is reeling from increased corporate insolvencies, and a shortage of skilled tradespeople is stifling large-scale construction efforts.

Shortage of Stand-Alone Homes

There appears to be no immediate solution to the ongoing shortage in the new housing market. Challenges such as limited land availability and extensive bureaucratic red tape are significantly hindering home builders from increasing the stock of new housing, which continues to exacerbate the supply issue in the market.

Property Investors Flood Back into the Property Market

Recall the missing ingredient for a property boom – It was confidence.

Recent trends show that property investors are now filled with this crucial ingredient.

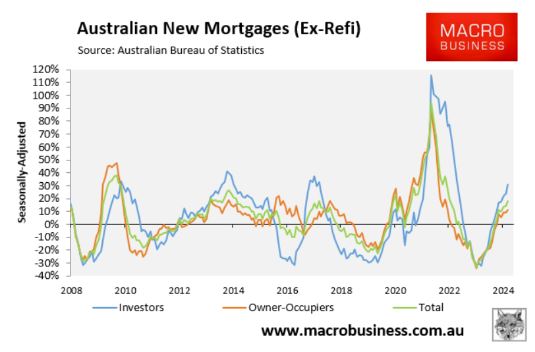

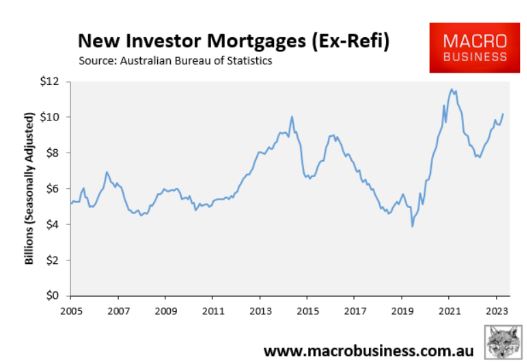

The evidence lies in the substantial rise in investor mortgage commitments, which soared by 31.1% in the year to March, significantly outstripping the 11.4% growth seen by owner-occupiers.

This marked increase indicates robust investor confidence in the market.

Property Investors Begin to Squeeze Out First Home Buyers

Property investors often play a pivotal role in driving a property boom.

Their generally greater borrowing capacity allows them to offer higher prices for properties, which can push market prices upward.

This dynamic squeezes out first-home buyers (FHBs), as the graph below demonstrates.

The graph illustrates an inverse relationship between investor mortgages and FHB mortgages, highlighting how increased investor activity can serve as a catalyst for upward price growth

Rents Continue to Rise – Making Investing in Property Attractive and Secure

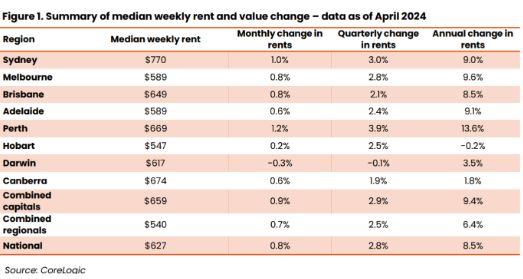

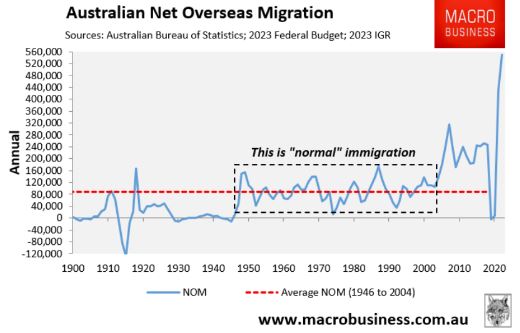

CoreLogic’s latest quarterly rental review highlights a significant upturn in rental growth during the first quarter of 2024, primarily driven by record levels of net overseas migration.

This surge has propelled median weekly rent values across Australia to a new peak of $627.

Notably, rental costs vary significantly across regions, with Sydney reaching as high as $770 per week, while Hobart maintains a more moderate rate at $547 per week.

Rents Continue to Rise – Making Investing in Property Attractive and Secure

CoreLogic’s latest quarterly rental review highlights a significant upturn in rental growth during the first quarter of 2024, primarily driven by record levels of net overseas migration.

This surge has propelled median weekly rent values across Australia to a new peak of $627.

Notably, rental costs vary significantly across regions, with Sydney reaching as high as $770 per week, while Hobart maintains a more moderate rate at $547 per week.

With interest rates stabilising and anticipated cuts in the next 12 months, property buyers and investors are gaining confidence in their financial positions.

The stability of knowing mortgage repayments will likely remain constant while rental incomes rise boosts their outlook.

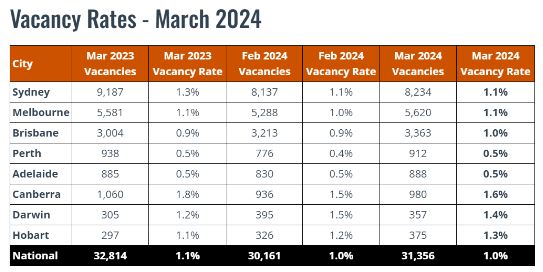

Additionally, with vacancy rates in capital cities remaining well below the balanced market threshold of 3%, the tenancy security of investment properties is further solidified, making it an opportune time for investment in the property market.

Overseas Migration Remains At Record Levels

Immigration remains at record levels, as highlighted in the graph below.

I won’t go into the details of Australia’s extreme population growth, as I’ve covered this topic in length in a previous blog.

However, this increase in population intensifies the demand for housing, impacting both the rental and purchase markets. As more people move to Australia, the heightened demand will likely drive up property values and rental rates.

As we look ahead, the signs for the next property market boom are unmistakable.

Driven by a combination of limited new supply, robust population growth, historically low vacancy rates, and stabilising interest rates – with anticipated reductions on the horizon – the stage is set for significant growth.

Moreover, rising investor loan commitments and substantial overseas migration are adding further momentum to this upward trajectory.

Over the past year, Wealthology has strategically directed our clients to regions like Perth, Brisbane, and Adelaide. Based on meticulous research and decades of experience, some of these regions have seen up to 20% growth.

These results confirm that our insights and strategies are aligned with market dynamics, positioning our clients at the forefront of potential booms.

This is just the beginning. The indicators are clear, and the opportunities for capital growth in the property market are compelling.

The time to act is now for those looking to make informed, strategic property investments.

Reach out directly at leonie@wealthology.com.au to discuss how you can benefit from these emerging opportunities and secure your financial future in the real estate market.