The age-old debate – who had it easier, the “ Baby Boomers “ or the “Millenials”?

I refuse to enter the debate about who had it easier when it comes to buying property.

But what I will be discussing today is how the Baby Boomers’ estimated worth of $4.9 trillion could be a massive factor in Australian property prices over the next ten years and why we could be looking at the most significant transfer of wealth in Australian history.

But what does this mean for you? Keep reading as we dissect this very important topic.

What is a Baby Boomer?

Just in case you are not familiar with the term, “baby boomers “ refer to a large generation born in the 18 years following the end of World War 2 when the birth rate shot up to 3.5 children per woman. The generation is often defined as people born from 1946 to 1964.

How Did the Baby Boomers Get so Wealthy?

The average Baby Boomer, born in the mid-1950s, entered university in the mid-1970s when Australian universities were tuition-free.

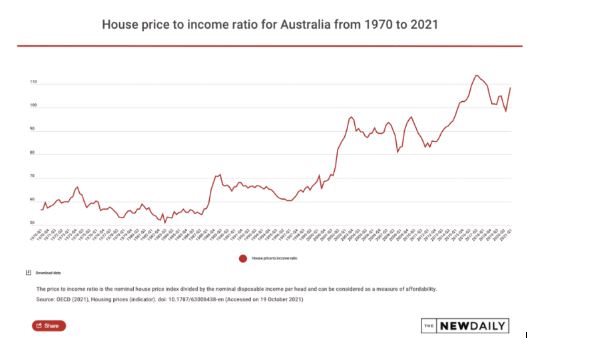

This era saw free education leading to lucrative employment opportunities. These Boomers bought homes around 1980 when real estate was highly affordable, witnessing property values skyrocket over the following decades.

Their financial success can be attributed to several key factors:

Homeownership and Mortgage Freedom: A significant portion of baby boomers own their homes outright, providing them with substantial equity and financial stability.

Superannuation and Education: Boomers were among the first to benefit broadly from superannuation schemes and had access to affordable or even free higher education, enhancing their wealth accumulation potential.

Asset Accumulation: Over their working lives, boomers have saved and invested wisely, benefiting from the long-term growth in property markets. This strategic financial management has positioned them with a robust asset base as they move into retirement.

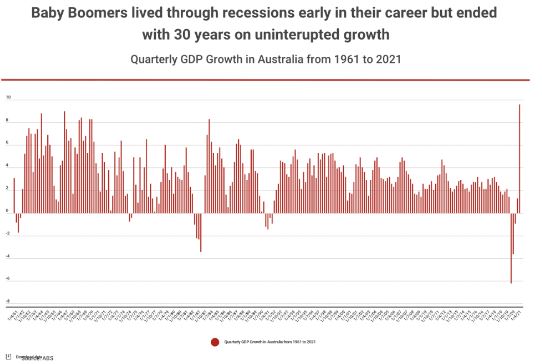

Economic Stability:

Australia enjoyed a stable economic environment from 1991 until the COVID-19 recession in 2020, creating an asset-rich Baby Boomer generation. This wealth accumulation offers a solid foundation for Millennials, who are the beneficiaries of their parents’ substantial asset base.

The Boom is Not Over for the Boomers

Australia’s baby boomers are steadily building their financial reserves, increasing their savings by 6.5% last year despite higher spending than other age groups.

Their financial stability is bolstered by lower or no mortgage debt, with many owning homes outright, thus avoiding rental costs. Additionally, they benefit from higher interest on savings and are less impacted by rising income tax payments.

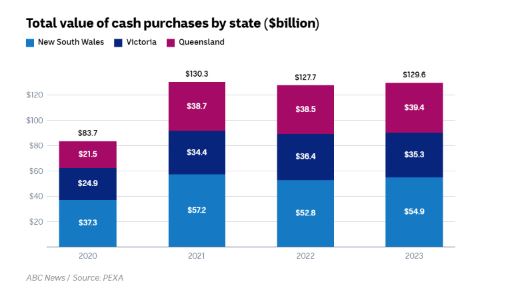

Data from PEXA reveals a growing trend of cash home purchases in Australia’s three largest states, predominantly by older Australians, highlighting their substantial financial clout.

$4.9 Trillion Worth of Wealth Transferred by 2034

We are currently witnessing what could be described as the greatest wealth transfer in modern history, at least in Australia.

Over the next decade, the baby boomer generation, who rode a wave of economic prosperity for decades, is forecast to pass on a staggering inheritance estimated at $4.9 trillion by 2034.

This isn’t just a transfer of assets; it represents a profound transformation in generational wealth.

Approximately $2.3 trillion is projected to be inherited by the children of baby boomers, while $1 trillion will make its way to the grandchildren, and a significant $1.7 trillion is slated for various charities.

When I first started investing, I did so without the help of my parents.

However, with help from the “Bank of Mum and Dad,” your journey to wealth could be dramatically fast-tracked.

This redistribution will have far-reaching implications for our nation’s social fabric, economy, and even political landscape.

However, its impact will be far from uniform, potentially creating both opportunities and challenges for the next generations.

The Flow on Affect For The Modern Days Property Market

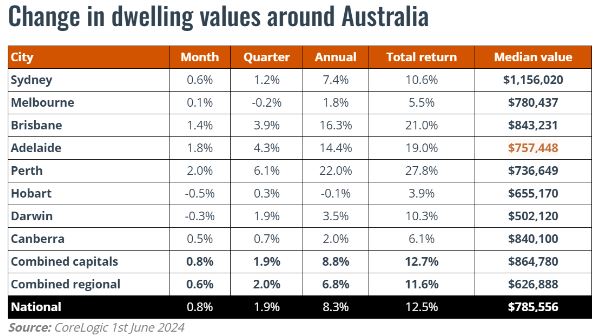

This influx of capital will likely drive further growth in the property market, especially in cities like Sydney ($1,156,000), Melbourne ($780,000), Brisbane ($843,000), Perth ($736,649) and Adelaide ($757,448 ), where affordability is already a significant issue.

Now, if only 20% of that $3.3 trillion passed down to descendants ends up in the property market, that equates to $660 billion. A $660 billion injection into an already really strong property market.

For young Australians, this trend is a double-edged sword. While some may benefit from inheritance, others will face heightened competition for increasingly expensive homes.

The “Bank of Mum and Dad,” which saw parents contribute an estimated $2.7 billion to help their children enter the real estate market in 2023, is set to become even more influential.

This wealth transfer may worsen the affordability crisis, potentially creating a two-tiered system favouring those with inheritance support or those who start their journey to building a property portfolio sooner rather than later.

You Are Your Own Solution! With or Without Inheritance

I firmly believe that Australia is heading towards a future where you either own property or you don’t.

It may not happen today or tomorrow, but it’s on the horizon, and my mission is to ensure you’re on the side that secures your financial future through real estate.

Whether you’re expecting an inheritance or not, believe it or not, property is still affordable. Every day, I assist people who have scraped together a deposit to buy property.

It might not be in their dream suburb or even in their state, but they’re leveraging our decades of experience and unparalleled market research to advance their financial positions.

Spencer and Leah – Turning $80,000 into $500,000+

When writing this blog, I instantly thought of one of my clients who found themselves in a situation whereby if they didn’t take the action that they did, their financial situation would be dramatically different.

Spencer and Leah both work as teachers in a Sydney school, earning a modest combined income but found that affordability in Australian’s most expensive city out of reach and discovered that as much as they tried, property prices kept rising faster than they could save.

They approached Wealthology and we implemented a strategy commonly known as rentvesting using detailed and analytical research we assisted them in purchasing an asset interstate for $529,000.

Fast forward 4.5 years, that property has grown by a staggering 54% or in other words close to $300,000.

They’ve since decided to not purchase in Sydney and have expanded their portfolio by another two properties. The total growth across the portfolio is now over $500,000.

Meaning that in just 4.5 years, Spencer and Leah have transformed their $84,000 deposit into a $500,000+ equity, and their entire portfolio costs them less than $190 per week in 2024.

30 Years of Building Australian’s Wealth

I’ll show you exactly how and what I’ve spent the last 30 years doing to help others create a better financial future for themselves.

Contact me directly at leonie@wealthology.com.au and take the first step towards securing your financial future. You’re worth it, after all.