You’ve probably heard the saying, “Cash is king.” Today, we’re diving deep into understanding cash flow: how it fluctuates, factors to consider, and why holding onto your property assets can improve your cash flow.

At Wealthology, we believe buying real estate is akin to running a business – success hinges on your ability to generate, balance, and forecast cash flow.

For property investors, this means aiming to live off the passive income your property portfolio generates. It’s crucial to strategically build a portfolio that can achieve this level of success over the long term.

Let’s be honest; we can’t rely on a pension alone to provide the security we need in our later years.

The good news is, with smart investments, you don’t need to take huge risks to see sensible returns.

Our research shows that holding property over the long term will only get easier, especially if you enter the market sooner rather than later.

Understanding Cash Flow

Investors often encounter terms like ‘positively geared’ or ‘positive cash flow’ but might not fully grasp their implications.

Positive Cash Flow

A positively geared property means the rental income and tax breaks exceed loan repayments and expenses. This results in a self-sustaining investment that doesn’t impact your regular income.

Negative Cash Flow

Conversely, negatively geared properties occur when rental returns and tax deductions fall short of covering loan repayments and expenses.

This leads to an income loss position.

However, the expectation is that capital growth will eventually offset these losses.

For instance, many of our clients have strategically acquired negatively geared properties, costing them as little as $50 per week out-of-pocket, banking on future capital appreciation.

The key advantage of negative gearing is the ability to offset property losses against other income, reducing overall tax liability.

This means ownership costs are supported by tenants (rent), tax savings, and personal cash flow.

A Negative Cash Flow Property Doesn’t Stay That Way Forever

Over time, as rents increase and property debt decreases, many investors transition to a positively geared position, ultimately replacing their wages with rental income.

Understanding That Successful Property Investing Is More Than Just Cash Flow

One mistake I see far too often is investors being solely focused on the cashflow right here, right now, and not looking at future forecasts or how changes in interest rates might affect them. This can also place an unbalanced impotence on cash flow as opposed to capital growth.

Speaking broadly and very generally, I’ve found that negative cashflow properties in the early years are some of the best performers for our clients.

Why I Avoid Top 100 Rental Yield Suburbs In Australia

When writing this blog, I decided to investigate the top 100 suburbs for rental yields in Australia, which is a major factor for positive cash flow and what I can say categorically is that I would never recommend a single suburb on this list.

This list is rife with regional areas highly dependent on mining and areas where 99% of the dwellings would be apartments.

My experience tells me that capital growth is hard to come by; when it goes bad, it really goes bad, and it is very hard to execute an exit strategy. Avoid, Avoid, Avoid!

You can view the entire list here: https://www.savings.com.au/home-loans/investing/top-australian-suburbs-for-rental-yield-revealed.

Why Negative Cashflow Properties Must Be Considered

In some circles, owning a negative cash flow property has a negative connotation, but what if I positioned it another way?

What if I said to you that if you give me $10,000 out of your yearly wages, I will, in return, give you $134,916 in 12-month times? It would be a no-brainer – at least, I’d hope it would be.

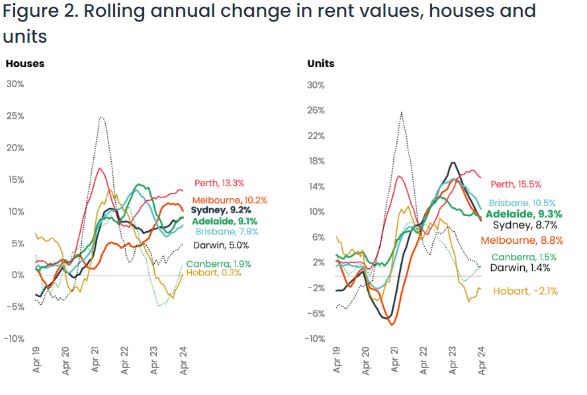

That’s exactly what’s happened to some of our clients in Brisbane, who, as you can see in the graph below, have experienced an annual increase in median prices of over 16%.

Whilst the majority of properties in Brisbane now have negative cash flows between $100 – $250 a week, Brisbane continues to be a great market to invest in due to its capital growth prospects.

This is where projections and forecasts are important to determine the longer-term play.

Now, I’m using Brisbane as an example, but the same story can be told in other cities, such as Perth and Adelaide.

Cashflow’s Can Change – Don’t Lose Sight of the Long Term

I’ve said it before, and I’ll say it again: Successful investors don’t buy property because it’s $30 a week cheaper to hold in 2024. Successful investors understand the complexity of the dynamics that make up a performing portfolio over the long term.

Are You Running Your Portfolio Like a Business?

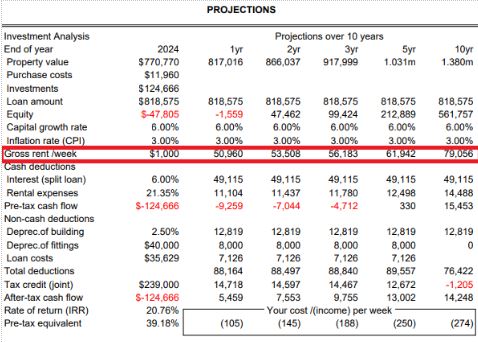

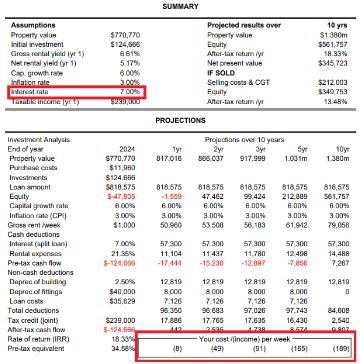

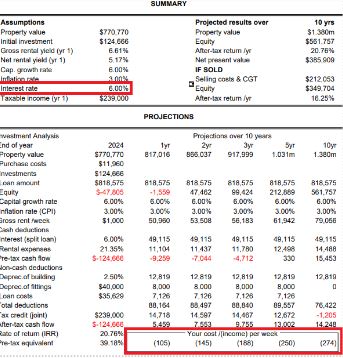

Just like running a business, investing in a profitable and sustainable property portfolio requires projections and research. In the exercise below, I’m going to outline some of the key metrics to consider using a real-life opportunity currently before one of my clients who is looking to invest with Wealthology.

Rental Growth – Is Your Property Likely to Grow in Rental Income?

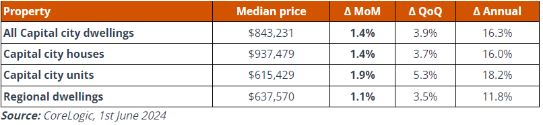

The media weekly rents across Australia continue to rise and recently hit a record high of $627 per week. It’s important to remember that if you buy a well-located, desirable property, the rent on your investment property will likely increase, improving your cash flow over time.

Interest Rates Have a Major Impact on Cashflow Positions

Currently, Australian interest rates are at a 13-year high, significantly impacting property cash flow due to increased mortgage repayment costs. However, the majority of the banks forecast rate drops over the next 12 months, or sooner.

For instance, with a 7% interest rate, a property in Western Australia might produce a positive cash flow of $8 per week. Lowering the rate to 6% boosts this to $105 per week, and at 5%, it could increase to over $210 per week.

Understanding these dynamics is crucial for investors aiming to maximise their returns.

Without Strategy and Analysis, You Are Taking A Massive Risk

Without strategy and guidance, property investing can be daunting. While figures may seem complex, it’s crucial to remember that cash flow is only one aspect of investing, alongside capital growth, depreciation, and rental income.

The ideal property investment considers all these factors and is guided by a meticulous strategy tailored to your personal situation, goals, and lifestyle.

If you’re interested in learning more or want to explore live opportunities with Wealthology, reach out to me directly at leonie@wealthology.com.au.

Discover more insights on these topics:

- Unlocking the Key: Maximising Australian Property Investment through Strategic Location Selection

- Demystifying Retirement: How Much Do You Really Need to Retire Comfortably?

- Reclaim your Tax Before End of Financial Year: A Guide for Property Investors