The Australian property market continues to generate a lot of interest, with each city presenting unique conditions that shape their housing sectors.

In this blog, we’ll explore the median house prices across Australian cities and examine why certain markets are performing better than others. Whether you’re a first-time buyer, an investor, or just curious about the trends, these insights will help you understand where value can be found in the current landscape.

Introduction to Median House Prices in Australia

Median house prices offer a clear snapshot of property values by representing the middle point in a list of home sales over a set period. Unlike averages, medians aren’t skewed by extreme highs or lows, making them a more accurate indicator for potential buyers and investors.

Comparing the Major Cities: Sydney, Melbourne, Brisbane, and Perth

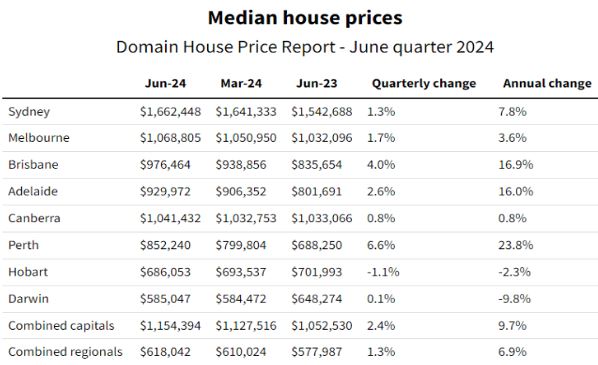

- Sydney: With a median house price of $1,662,448, Sydney remains Australia’s most expensive city. A 1.3% quarterly increase, affordability remains a major challenge for many buyers.

- Melbourne: At $1,068,805, Melbourne follows closely behind. Its quarterly growth is more subdued at 1.7%

- Brisbane: Brisbane offers better affordability with a median price of $976,464, yet it has seen the most impressive annual growth rate at 16.9%. The city is popular for both investors and families seeking a more budget-friendly alternative to Sydney.

- Perth: Perth stands out not just for its affordability at $852,240 but also for its explosive growth. With a 6.6% quarterly growth rate and a 23.8% annual change, Perth has rapidly become a top-performing market, offering significant opportunities for both investors and homebuyers.

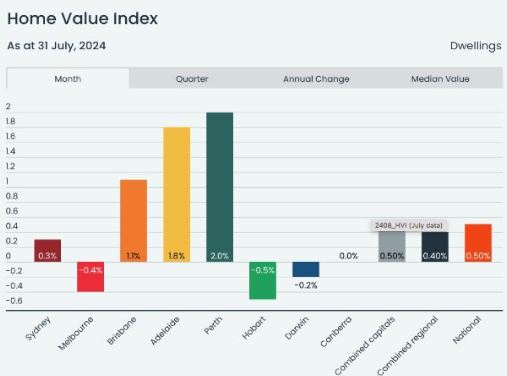

Here’s how things have changed in the month of July.

If things continue the same this month this would equate to a monthly growth of:

- Perth @ 2% growth = +$17,044

- Brisbane @ 1.1% growth = $10,741

Now, let’s look at the daily change in values:

Current Market Overview: June 2024 Insights

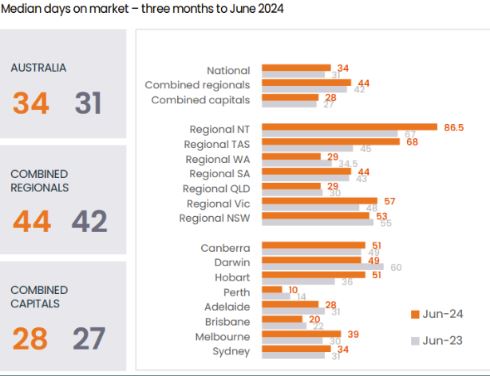

According to recent data for the three months leading up to June 2024, the Australian property market continues to experience significant momentum.

The national average sits at 34 days on the market, with Perth and Brisbane leading the pack in terms of demand, with median days on market as low as 10 and 20 days, respectively.

The competition among buyers remains fierce, with properties in some regions being snapped up almost as soon as they hit the market.

This demand reflects strong buyer confidence and limited supply, leading to rapid price growth, particularly in cities like Perth and Brisbane.

Key Factors Driving Price Differences Across Regions

Several factors influence these varying prices and market performances:

- Supply and Demand: Perth and Brisbane benefit from tight supply, pushing prices higher. In contrast, Sydney’s high prices are driven by both ongoing demand and limited availability.

- Affordability: While Sydney and Melbourne remain expensive, cities like Brisbane and Perth are more appealing due to relatively lower entry points, making them attractive for first-time buyers and investors.

- Economic Conditions and Infrastructure Development: Cities with booming local economies and ongoing infrastructure projects tend to attract more buyers, resulting in higher demand and price growth.

The Wild Wild West

Perth has been Australia’s top-performing market over the past 12 months. 2% rise in values in June and again in July. An impressive 23.6% increase over the last financial year.

This annual gain translates to $165k in added value on a $700k purchase!

Perth is Still Affordable and Perth’s dwelling values remain more affordable than eastern capitals. The scarcity of supply is evident, with listings nearly 47% below the previous five-year average.

A recent purchase of a new block of land with a house for early $600,000’s by a client increased in value by $60,000 in the 12 weeks it took for them to secure finance from the bank!

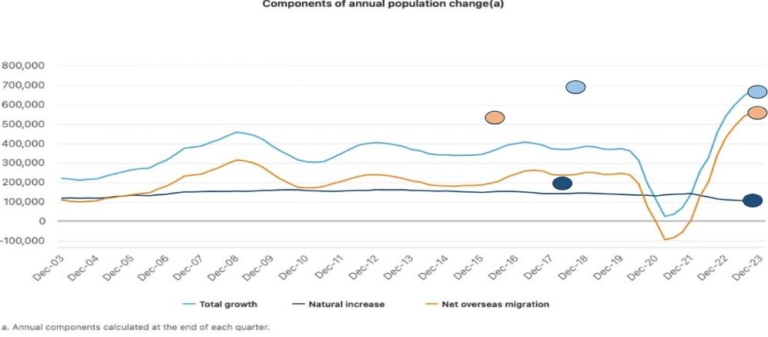

Population Boom Fuelling Growth

Perth’s market is currently on fire, driven by an unprecedented surge in population growth.

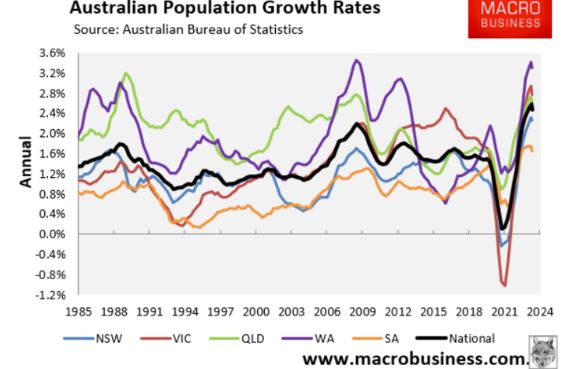

WA population increase of 3.3% in 2023, outpacing the national average of 2.5%.

This boom is largely fuelled by record net overseas migration and significant interstate migration, as shown in the graph above.

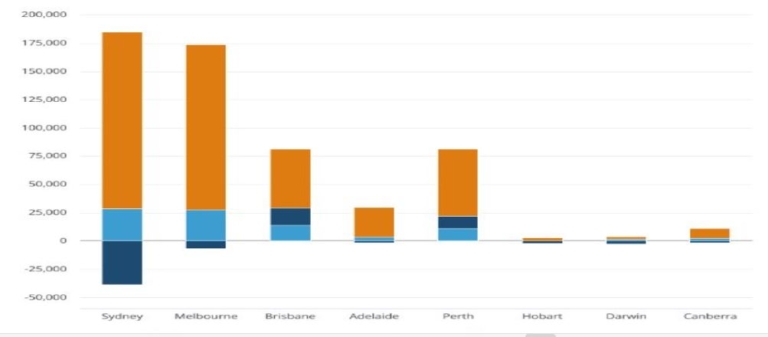

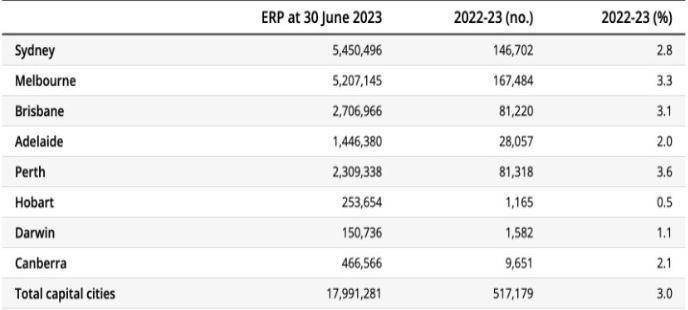

Components of Annual Population Boom

Components of Population Change by Capital City 2022 – 2023

Population Change by Capital City

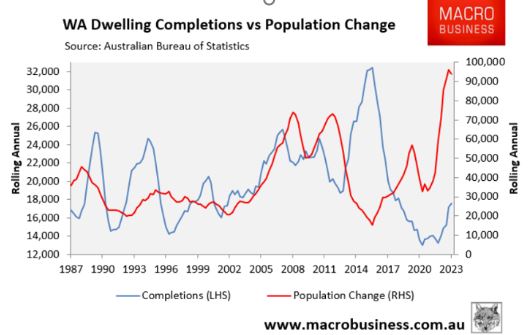

WA Dwelling Completion vs Population Change – Supply is Not Keeping Up

The construction rate is simply not keeping up. In 2023, WA’s population grew by 93,800, yet only 17,500 new dwellings were constructed.

Annual Change in Rental Rates

When it comes to rental growth, Perth stands head and shoulders above the rest of Australia.

Over the past year, Perth’s rental rates have surged by an impressive 13.2%, far surpassing the national average of 8.2%.

12 months ago if your investment property was renting for $600 pw:

… In Perth it would have increased by $79 pw

… In Brisbane it would have increased $48 pw

What This Means for Buyers and Investors

Rental growth reflects the strong demand and low vacancy rates in the city, positioning Perth as an increasingly attractive destination for property investors. This environment is leading to higher returns and improved cash flow for investors, further fuelling market momentum.

Understanding these trends can help you make informed decisions. If you’re considering entering the market, Perth and Brisbane currently present opportunities for substantial capital growth. Key when building a property portfolio.

Making the Right Decision Based on Market Trends

The Australian housing market remains diverse, with each city offering unique opportunities depending on your goals. As the data shows, cities like Perth and Brisbane are seeing rapid growth, making them prime locations for those looking for value and growth potential.

Whether you’re a seasoned investor or just starting out, having a clear understanding of median house prices and regional differences is key to making the right move. Now is the time to evaluate your options and consider where you’ll find the best return on investment.

Ready to Take the Next Step?

If you’re considering a purchase or investment and want expert advice tailored to your goals, reach out directly at leonie@wealthology.com.au. Let’s work together to navigate the market and make the most out of your real estate journey.