Hold onto your hats because the roller coaster ride, we call the property market has just turned up a gear! This time we’re on our way up!

If you’ve read many of our blogs about property cycles, you’ll know that the property market is anything but a roller coaster; think of it as more of an escalator with a few plateaus and the very rare step backward, but nonetheless, I’m excited to share with you my take on some recent data that indicates property prices are on their way up.

Property Prices Are Rising

It’s important to remember that the Australian property market is not “one” big market and that each city, and even suburbs, perform separately from each other depending on various factors.

Over the past twelve months, Australian property prices, from a macro perspective, have been going through an adjustment phase and have experienced a drop in property values. However, that may be a thing of the past.

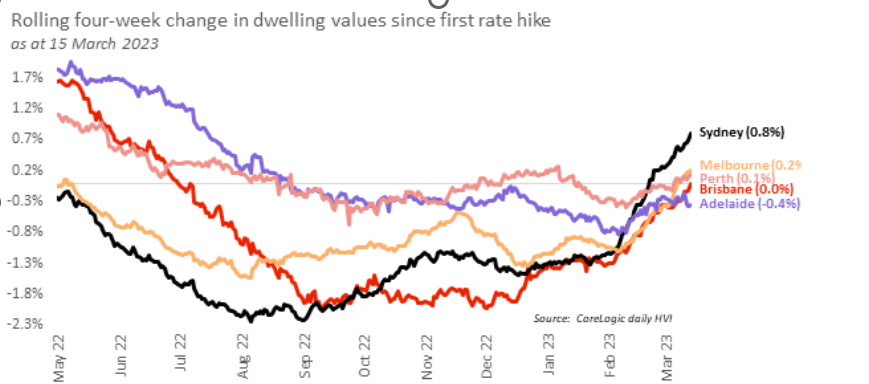

New data obtained from CoreLogic has highlighted the fact that property values in some Australian capital cities grew in the past month, and that momentum was carried into March.

At the time of writing this blog, Sydney values were 0.5% higher over the first half of March, Melbourne and Perth were 0.2% higher, whilst home values in Brisbane remained stable.

Of most interest is the change in dynamics in the Sydney market. In almost three decades of investing in real estate, I’ve always found the Sydney market to be a good indicator for monitoring the change of stages in a property cycle.

Often the Sydney market is the first to move nationally, and with the data suggesting an increase in prices in Sydney, I have reason to be optimistic about the future of Australian housing values and the next stage of the cycle that is imminent.

International Buyers are Back in a Big Way

The Chinese property buyers are back in Australia, and in a big way! Borders have opened for the first time this month since the pandemic and Australia is top of the prospective Chinese property purchasers’ wish lists.

My research indicates that the wave of Chinese money is the single most significant investment source in the Australian housing market at an estimated $1.6B in the past six months.

At these levels of investment, China will have invested over $3.2B in 2023, up from $2.4B from the previous year. Moreover, it shows no signs of slowing down, with data from international property marketplace Juwai IQI showing an increase of 24% in inquiries for Australian real estate from Chinese buyers.

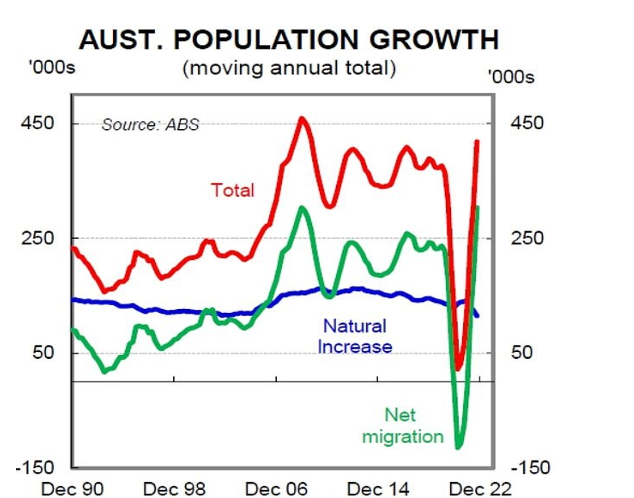

Number of New Immigrants to Australia Hits 15-Year High

Not even the bigwigs in politics could have imagined the number of international immigrants recently hitting Australian shores.

That number stands precisely at 303,700 up to September 2022, which took Australia’s population over 26 million, marking the most significant overseas increase since late 2008.

The federal budget forecasted approximately 180,000 for 2022-2023; boy, did they get that wrong.

This influx of new residents will likely increase Australian house values as new migrants look to buy instead of entering the tough rental market.

The vast majority of Australia is experiencing a severe undersupply in rental accommodation, and this extra demand is sure to put further strain on renters out there. In addition, with more competition brings an increase in rents.

To provide a global context on how fast Australia is growing, the population grew by 1.6% in the past 12 months, New Zealand grew by just 0.2%, and the U.S. increased by 0.4%.

The Window of Opportunity

In my last blog, I wrote about the missing ingredient to a property boom. That ingredient was confidence. With prices rising, international investors back on the radar, and Australia’s population booming, confidence is building within the Australian property market.

Uncertainty surrounding interest rates is still the stumbling block for many. However, many economists are now predicting a pause or halt in rate rises. Of course, only time will tell whether this will happen now or later in the year. However, time has already told property owners in Australia that property is the number one asset class in Australia. It holds over 60% of household wealth for a reason – it’s safe.

Let’s chat ideas and strategies on how to catapult your wealth just like I have done for myself and countless other Australian families – leonie@wealthology.com.au