Interest rates… Ah, a topic that seems to be on everyone’s lips these days.

Interest rates have become a sizzling subject, and in this blog, we’re diving headfirst into the intricate interplay between record interest rate rises and the ever-evolving Australian property market.

As seasoned property investment experts, Wealthology is here to equip you with an in-depth understanding of the opportunities and challenges that lie ahead for property investors in today’s market.

So, buckle up as we embark on a data-driven journey so you can seize the opportunities while navigating this uncharted territory for a course destined for success!

The Economic Landscape: Are Interest Rates Really That High?

Since April 2022, the Reserve Bank of Australia (RBA) has implemented a series of rate hikes, marking a significant shift from the previous decade’s rate cuts.

The RBA’s decision to raise interest rates was prompted by concerns about surging property prices, inflationary pressures, and a booming economy.

In the first half of 2023, the rollercoaster ride of mortgage rates persisted, with fluctuations for rates ranging between the low 6%’s and high 6%’s. While the record-low rates of 2020 and 2021 are now behind us, today’s mortgage rates remain relatively low when compared to historical standards.

Dramatic changes in interest rates are nothing new. Reflecting on the past, from 1990 to 2023, the average mortgage rate for three-year loans experienced a rollercoaster ride, reaching its peak at a staggering 15.50% and plummeting to as low as 2.14%.

In 1974, mortgage rates surged above 10% for the first time, and they remained persistently high until the mid-1990s.

Towards the end of the 1990s, mortgage rates eventually found some stability, hovering around 6.5% with remarkable consistency.

Since the early 2000s, mortgage rates have maintained a relatively narrow range, fluctuating between 4.5% and 8%.

Market Resilience: Surprising Growth Amidst Challenges

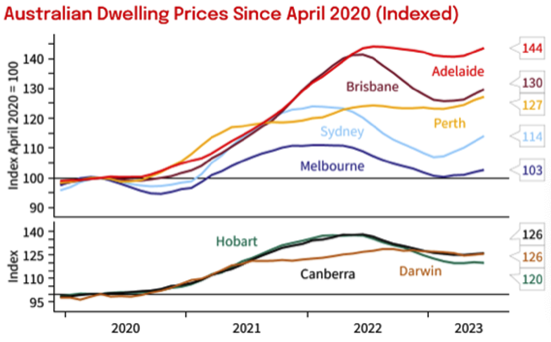

Despite apprehensions about the impact of interest rate hikes, the Australian property market has demonstrated resilience.

Year-to-date, combined capital city property values have risen by an impressive 3.5%.

This growth speaks to the underlying strength of the market and the potential for long-term capital growth for astute investors.

The continued demand for residential properties, particularly in major capital cities like Sydney, Melbourne, and Brisbane, has bolstered market performance.

The combination of low housing supply and sustained buyer interest has contributed to the market’s resilience against the headwinds of rising interest rates.

Ah, the memories of the doomsday predictions! Remember when those naysayers were forecasting a whopping 30% drop in property prices? It’s hard to find them now, as the market proves them wrong!

What Are the Major Banks Predicting?

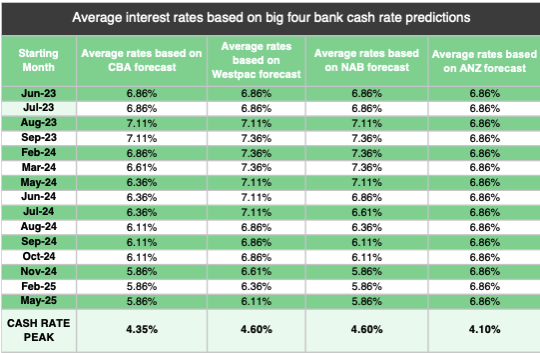

As the new RBA governor, Michele Bullock prepares to make her first interest rate decision, economists and financial institutions have presented varying predictions for future rate movements.

ANZ suggests a potentially extended pause with a cash rate of 4.1%, while both Westpac and NAB foresee further rate hikes before cuts in the following year.

On the other hand, CBA and NAB anticipate substantial cuts, projecting a cash rate of 3.1% by the end of 2024.

The uncertainty surrounding the future path of interest rates underscores the importance of informed decision-making for property investors.

Seizing Opportunities: Window of Opportunity

The current property market presents a promising window of opportunity for investors.

On average, properties are still below their recent peaks, offering potential bargains for those ready to capitalise.

This moment calls for prudent decision-making, with investors carefully analysing market data, regional trends, and property fundamentals to identify undervalued assets.

Property investors who act decisively and strategically during this phase can secure properties at favourable prices, positioning themselves for potential capital growth as the market regains momentum.

Market Activity Surge: Unwavering Buyer Confidence

Despite interest rate hikes, market activity remains vibrant, reflecting unwavering buyer confidence.

Preliminary capital city clearance rates consistently hold above 70%, showcasing robust demand for properties.

This surge in market activity can be attributed, in part, to strong population growth, historically low borrowing costs, and increased household savings during the pandemic.

Property investors who leverage Wealthology’s tailored strategies and guidance will be well-positioned to capitalise on this enthusiasm and make well-timed investment decisions aligned with their financial goals.

The Rental Market Advantage: A Shield Against Rate Increases

As interest rates rise, the rental market emerges as a key advantage for property investors.

Tightening market conditions has led to exceptionally low vacancy rates, increasing asking rents. The rental income boost serves as a buffer against the impact of interest rate increases, safeguarding investors’ financial stability.

Property investors with well-located and well-managed rental properties can benefit from increased rental income, providing a level of insulation from rising borrowing costs.

A Positive Outlook for Steady Rental Growth

The rental market maintains a strong outlook despite potential economic headwinds.

Low vacancy rates and limited new property supply indicate a continuation of rent increases.

As the interest rates stabilise, rental demand is expected to remain strong, with tenants seeking quality properties in desirable locations.

Our meticulous market projections equip investors with the foresight to leverage rental opportunities and optimise returns, ensuring their rental properties remain a steady source of income and contribute to overall investment success.

Navigating The Australian Property Market

In conclusion, record interest rate rises may have ushered property investors into unfamiliar territory, but the prospects are far from daunting; after all, this is nothing new.

Armed with the data-backed insights of Wealthology and our dedication to your financial success, you can confidently navigate this dynamic landscape.

The Australian property market has exhibited remarkable resilience, presenting a wealth of opportunities for investors to seize.

As we steer through the uncharted waters of interest rate fluctuations, Wealthology stands ready to guide you with our in-depth research, tailored strategies, and unwavering commitment.

Together, we will capitalise on the current market window, leverage rental advantages, and pave the path for long-term prosperity.

Embrace the journey with us as we unlock the potential of the Australian property market.

For expert guidance and comprehensive support, visit www.wealthology.com.au today or reach out to me personally at leonie@wealthology.com.au