Heya property lovers, it’s Leonie here, and as I mention in the title, I’m here to chat with you today about the significant implications Australia’s surging population growth is going to have on the property market.

I’m afraid to say that today’s blog will certainly not be all good news… In fact, Australia’s surging population will surely bring severe implications for many Australians and financial rewards for many others.

The good news is, though, all is not set in stone, so you still have time to make sure you’re in a position to capitalise.

But will you? Let’s find out.

650,000 New International Migrants

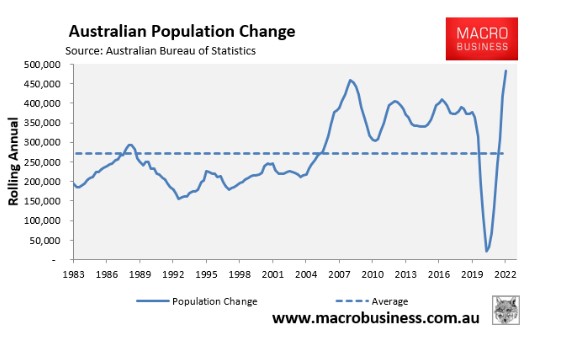

According to the latest Treasury data, a whopping 650,000 new migrants are expected to call Australia home in the next two years. That’s on top of the 400,000 newcomers who arrived in 2022.

Wow, that’s a lot of people! But it’s all about perspective. So to simplify, that’s adding the population of the Gold Coast and Toowoomba combined to Australia’s existing population. Crazy stuff!

And guess what? It’s all part of the Albanese Government’s immigration agenda, which has been turbo-charging the numbers of international arrivals. Talk about a population boom!

Big Boost to the Economy and the Property Market

Now, you might be thinking, “Hey Leonie, that’s great for the economy, right?” Well, you’re spot on! Migration can provide a significant upside to Australia’s balance sheet.

In fact, the Grattan Institute estimates that just 40,000 skilled migrants alone could add a whopping $38 billion boost to our federal and state governments over the next decade. Cha-ching!

How? Well, it all comes down to taxes. Bringing more people to Australia means more people in the workforce, resulting in more taxes paid.

But hold on to your hats, folks, because here’s where things get interesting for the property market.

With more people arriving into the country, there will be a higher demand for housing, both for sale and rent.

And you know what that means – brace yourselves for RISING PROPERTY PRICES!

As if the property market needed to show more signs of a recovery.

The Dark Side of Migration

As the old saying goes, “One man’s pain is another man’s profit“, which is the reality of this situation.

Australia’s already strained rental market, with high demand and low vacancy rates in major cities, is expected to face even more challenges with the influx of migrants.

As more people compete for limited rental properties, rents will likely increase, making it harder for lower-income earners and families to afford housing. It’s like a never-ending game of musical chairs but with rental properties instead!

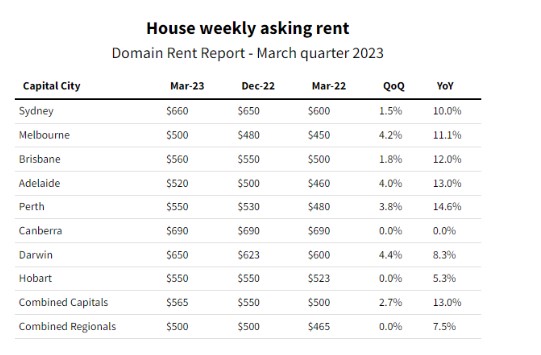

The effects of international migration on Australia’s rental market is no laughing matter. With rents already at record highs, the prospect of an additional 650,000 newcomers in the next two years is enough to make anyone renting break into a cold sweat.

House rents in the combined capitals have risen a staggering 2.7% this quarter alone, contributing to a jaw-dropping 13% increase over the past year.

Just take a look at the numbers: the average rental price in Sydney is already a staggering $660, which includes small apartments and granny flats, followed by $500 in Melbourne, $560 in Brisbane, $520 in Adelaide, and $500 in Perth.

To make matters worse, vacancy rates across the country are at an all-time low of 0.8%, with Sydney, Melbourne, Brisbane, Darwin, and the combined capitals all experiencing declines.

Wealtholgy clients can testify to the demand currently seen in the rental market. For example, one of my clients in Brisbane received 28 applications in 24 hours on their investment property, and it rented for $50 above the asking price.

Rents in some areas which our clients have invested in have increased by $110 per week in just over a twelve month timeframe.

It’s a tough market for renters, and the influx of more people is only expected to fuel this already fiery situation.

Property Investors Set to Cash In

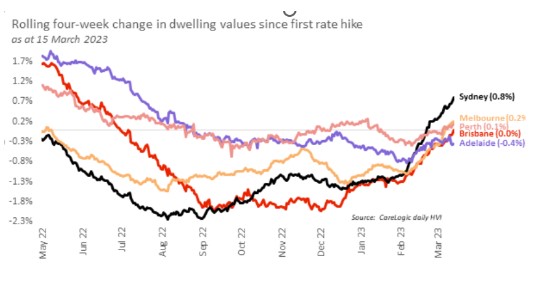

It’s not only the rental market that is expected to heat up; the sales market is also likely to benefit from the population boom.

I can’t help but get excited about the opportunities that international migration can bring to the property market in Australia. With rents at record highs and house prices rising, the potential for capital growth presents an exciting prospect for property investors.

As I spoke about in my last blog, property prices across Australia have already started to rise. I won’t get into the data on that one, but this wave of new residents will only further put pressure on supply.

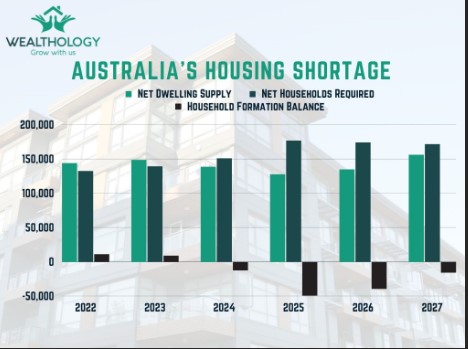

According to data, Australia is already facing an undersupply of 124,100 dwellings by 2028. That’s a clear indicator that property prices will likely increase, creating a favourable environment for property investors.

Imagine riding the wave of capital growth as the demand for housing continues to soar. By investing wisely and strategically, property investors can position themselves to benefit from the increasing demand from a growing population.

So, if you’ve been considering dipping your toes into the world of property investment, now might be the perfect time to take the plunge!

Contact me directly at leonie@wealthology.com.au to chat about ideas, strategies and wealth.